Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Amidst a backdrop of shifting economic indicators, inflation trends are emerging as a significant factor influencing buy-to-let investment sentiment, particularly in the UK housing market. Recent data releases for Consumer Sentiment and Final Core CPI figures, have provided insights into consumer behaviour and price stability, impacting currency pairs like EUR/USD and GBP/USD. However, it's the broader implications of inflation trends that are catching the attention of buy-to-let landlords in the UK. As the Dollar Index remains in focus, landlords are eyeing potential opportunities spurred by declining inflation, a factor that could enhance the profitability of buy-to-let property investments, including HMO properties and student housing. This article delves into how the current economic landscape, characterised by inflationary shifts, is fostering optimism among buy-to-let landlords in the UK.

Inflation directly affects the overall cost of living and can decrease the value of money if wages do not increase at the same pace. The Bank of England adjusts interest rates in response to inflation levels, raising rates to slow spending and encourage saving, which in turn tends to lower inflation.

High and volatile inflation is generally considered damaging to the economy, but certain individuals and sectors may benefit.

Workers with wage bargaining power, producers with rising prices, and asset owners such as property and stockholders may see benefits from inflation.

However, retired individuals on fixed incomes and the poorest members of the population may suffer from the decrease in the real value of pensions and savings, as well as higher costs of borrowing and living expenses.

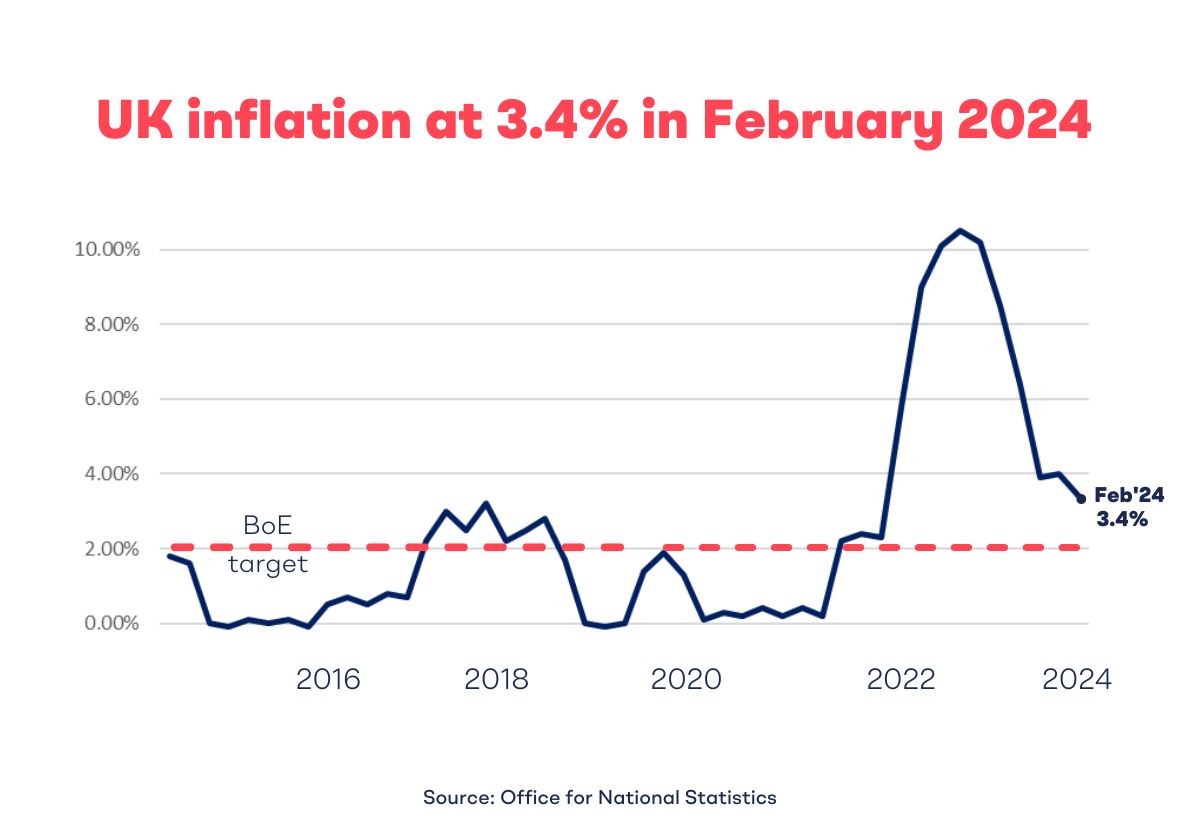

In February, UK inflation dropped to 3.4% from January's 4%, marking its lowest rate in nearly two and a half years.

This decline in inflation rates has raised hopes among buy-to-let landlords for favourable conditions in the property market.

Despite the drop in inflation, the Bank of England opted to maintain its base rate at 5.25% during its recent decision. This decision indicates the bank's cautious approach and its wait for further evidence of a sustained decrease in inflation before considering rate cuts.

Ashish Saraff, Founder and CEO of Novyy Group suggests that interest rates are very likely to start reducing from Q3-2024 making BTL more lucrative than other asset classes once again. Rates are already 20-25% cheaper than the peak last year, and should continue to fall in 2024 before stabilising in 2025.

Gavin Richardson, Managing Director of mortgage broker MFB, suggests that the Bank of England is likely to remain cautious, keeping the current rate unchanged until at least June because of volatile money markets.

Richardson anticipates that minor reductions in BTL mortgage rates could occur following the latest inflation figures, with more significant reductions expected once the Bank of England decides to lower the base rate.

SWAP rates, rather than the Bank of England base rate, primarily influence most BTL mortgage rates. We expect the recent inflation figures to instil confidence in the markets, potentially leading to tentative rate reductions.

Mortgage rates experienced a significant decrease in January due to a rate war among lenders but saw a slight increase in February amid expectations of sustained higher interest rates.

The persistence of stubborn core inflation remains a challenge for the Bank of England, delaying rate-cut expectations and maintaining upward pressure on mortgage costs. Despite hopes for rate cuts soon, experts suggest that a more realistic timeline for favourable mortgage rate reductions may be during the summer months, providing potential relief for buy-to-let landlords facing profitability challenges. This suggests that the recent decline in inflation rates could signal positive developments for buy-to-let landlords, offering prospects of improved mortgage affordability and bolstering optimism in the UK buy-to-let market.

Market Performance: The market witnessed a robust first-quarter rally with the S&P 500 up by 10%, setting a record-breaking start to the year since 2019. This rally was not limited to specific sectors but was broad-based across various asset classes, including stocks, cryptocurrencies, and safe-haven assets like gold.

Investor Sentiment: Investors have shown bullish sentiment, fuelled by resilient corporate profits and enthusiasm around developments in artificial intelligence. The buoyant market sentiment has been further supported by hopes that the Federal Reserve will consider interest rate cuts, indicating a positive outlook for investment opportunities.

Stock Performance: The dominance of big technology stocks known as the "Magnificent Seven" faded slightly in the first quarter, but the rest of the market remained buoyant. With AI-related stocks leading the charge, more than half of the S&P 500 stocks hit fresh 52-week highs.

Economic Outlook: Despite concerns about potential risks, such as inflation and earnings growth, the underlying strength of the economy continues to drive investor optimism. Consumer spending remains brisk, employers are hiring, and unemployment remains below 4%, indicating a favourable economic environment for investment.

The BTL mortgage market has witnessed notable fluctuations in recent months, with rates responding to changing expectations regarding interest rate trajectories. January saw a brief "rates war" among lenders, leading to a temporary easing of mortgage rates. However, February saw a reversal of this trend as lenders reacted to the prospect of sustained higher interest rates driven by persistent core inflation. Tom Bill's (head of UK residential research at Knight Frank) analysis highlights the challenges faced by landlords in navigating these dynamic mortgage rate dynamics, underscoring the importance of monitoring inflation trends for informed decision-making.

The discussion surrounding potential interest rate cuts presents diverse perspectives from industry leaders. Nathan Emerson, CEO of Propertymark, views the current environment as conducive to a rate cut, offering potential benefits for the housing market and BTL landlords alike. However, George Sweeney of finder.com urges caution, emphasising the complexity of economic indicators and the potential delay in monetary policy adjustments. These contrasting viewpoints reflect the nuanced nature of interest rate forecasting and its impact on the buy-to-let sector.

Despite the uncertainty surrounding interest rate movements, the recent slowdown in inflation offers a glimmer of hope for BTL landlords and the broader property market. The convergence of expert opinions on the potential benefits of a rate cut underscores a sense of cautious optimism within the industry. As stakeholders await further developments, proactive landlords may find opportunities to capitalise on evolving market conditions, positioning themselves for success in the dynamic landscape of buy-to-let investment.

Recent mortgage market developments present favourable conditions for buy-to-let (BTL) landlords amidst changing economic dynamics.

Enhanced Accessibility to Financing: The Yorkshire Building Society's new offering allows first-time buyers to access loans of up to 99% of property value with a minimal deposit requirement of £5,000. This increased accessibility could stimulate demand in the housing market, benefiting BTL landlords.

Dynamic Mortgage Rate Adjustments: Lenders like HSBC, Barclays, and Virgin Money are adjusting rates in response to shifting economic trends, including declining UK inflation and speculations of future interest rate adjustments. These adjustments offer insights into the evolving financing landscape for property investors.

Optimistic Outlook for Landlords: As lenders recalibrate offerings and market sentiment shifts, BTL landlords can benefit from favourable borrowing conditions and increased accessibility to financing options. Proactive investors can leverage expert insights to navigate uncertainties and optimise their investment strategies.

Informed Decision-Making: With uncertainties surrounding interest rate adjustments, informed decision-making becomes crucial for BTL investors. By staying abreast of market developments and leveraging expert advice, landlords can position themselves strategically to maximise returns in the evolving property investment landscape.

The recent drop in inflation rates offers a silver lining for buy-to-let landlords in the UK, fostering optimism and improving profitability prospects in the property market. While uncertainties persist regarding potential interest rate adjustments, this subdued inflationary environment presents an opportune moment for landlords to capitalise on enhanced mortgage affordability and favourable market conditions.

Navigating through economic shifts and monetary policy decisions requires informed decision-making and proactive investment strategies. By staying informed, leveraging expert insights, and adopting forward-thinking approaches, landlords can position themselves strategically to maximise returns and thrive in the dynamic property investment landscape.

With the potential for reduced borrowing costs and increased financing accessibility, buy-to-let landlords are poised to seize opportunities and drive growth in the property market. The decline in inflation rates serves as a catalyst for renewed confidence and optimism among buy-to-let investors, signalling a brighter future for property investment in the UK.