Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

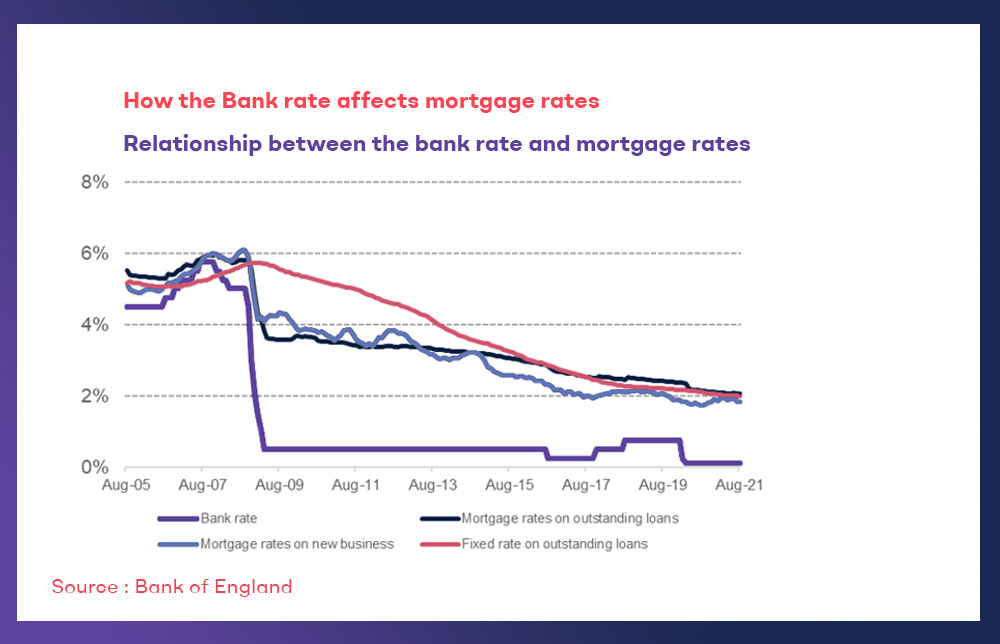

The interest rate established by the Bank of England (BoE), commonly known as the Bank Rate or the base rate, has a major impact on mortgage rates. The Bank Rate is the interest rate at which the Bank of England lends money to commercial banks; it is used as a basis for comparison with other interest rates. The Bank of England (BoE) sets the Bank Rate to promote economic growth and reach the BoE's inflation objective of 2% following the coronavirus outbreak.

Energy shortages, supply chain disruptions, and strains on the labour market have led to growing inflation in 2023, which the BoE has responded to by steadily increasing the Bank Rate. From an all-time low of 0.1% in December 2021, the Bank Rate has risen a total of 13 times since then, peaking at 5% in March 2009. If inflation does not ease, the Bank of England may raise interest rates again.

Higher mortgage rates for borrowers are one way in which rising interest rates can affect the housing industry and the economy at large. Those looking to buy a home will have less disposable income if mortgage rates continue to rise. Existing borrowers, particularly those with variable-rate mortgages tied to the Bank Rate or their lender's standard variable rate (SVR), will see a rise in their monthly payments. Increasing mortgage rates can have a chilling effect on the housing market by discouraging homeowners from selling or remortgaging their homes.

Mortgage rates and interest rates are interconnected. The broad financial market and changes in the interest rates set by central banks have an impact on mortgage rates. Mortgage rates typically climb in response to increases in interest rates, and vice versa when interest rates fall.

Long-term interest rates, rather than short-term rates set by central banks, like yields on government bonds, often affect mortgage rates. This is because mortgages are lengthy debts, generally lasting 15 to 30 years. To attract investors and control their costs, lenders must match the interest rates on mortgages with the current long-term interest rates.

Novyy is dedicated to keeping investors aware of important issues that can affect their investments. Novyy is a prominent real estate investment company that specialises in fractional ownership and offers rental income opportunities. Real estate investors must be aware of the potential effects on mortgage rates following recent reports of an increase in the bank rate. In this blog article, we examine the potential effects of rising interest rates on mortgage rates and how they might affect real estate investors.

Despite little change in the Bank Rate, historical data shows that mortgage rates have steadily decreased to nearly record low levels. Strong market competitiveness and a consistent supply of wholesale capital are to blame for this tendency. The overall impact on mortgage rates is anticipated to be relatively low, even with the Bank Rate's indicated moderate hike.

As a result of lenders increasing their fixed-rate and tracker plans in anticipation of more BoE rate hikes, many borrowers are currently paying rates that are higher than that. On Wednesday, the average fixed-rate mortgage for two years touched 6.15%, while the average for five years was 5.79%, as reported by The Guardian. This is the highest point since August 2008, before the worldwide financial crisis.

The effects of an increase in mortgage rates will be different for each borrower, property, loan-to-value ratio, borrower income, borrower credit, and property value. It's possible that some borrowers can reduce their payments by switching to a more affordable plan or by extending the length of their loan. Still others may be unable to make their mortgage payments or may even be in a position of negative equity.

Rising mortgage rates could have several effects on the housing market. While low interest rates, government programmes, and shifting tastes during the epidemic have caused housing prices to skyrocket in recent years, increasing mortgage rates could decrease buyer desire and hold down price increases. However, if homeowners are discouraged from selling or upgrading their houses due to rising mortgage rates, this could lead to a lack of available properties on the market.

How quickly and how much mortgage rates rise, along with the state of other variables like income growth, consumer confidence, unemployment, and government policies, will determine the overall impact on the housing market. In 2023, a slowdown in real estate transactions and a fall in home values are expected, attributed in part to higher mortgage rates, according to some analysts. Some people think that rising mortgage rates won't affect the market much as long as they remain historically low and are reflective of a robust economic recovery.

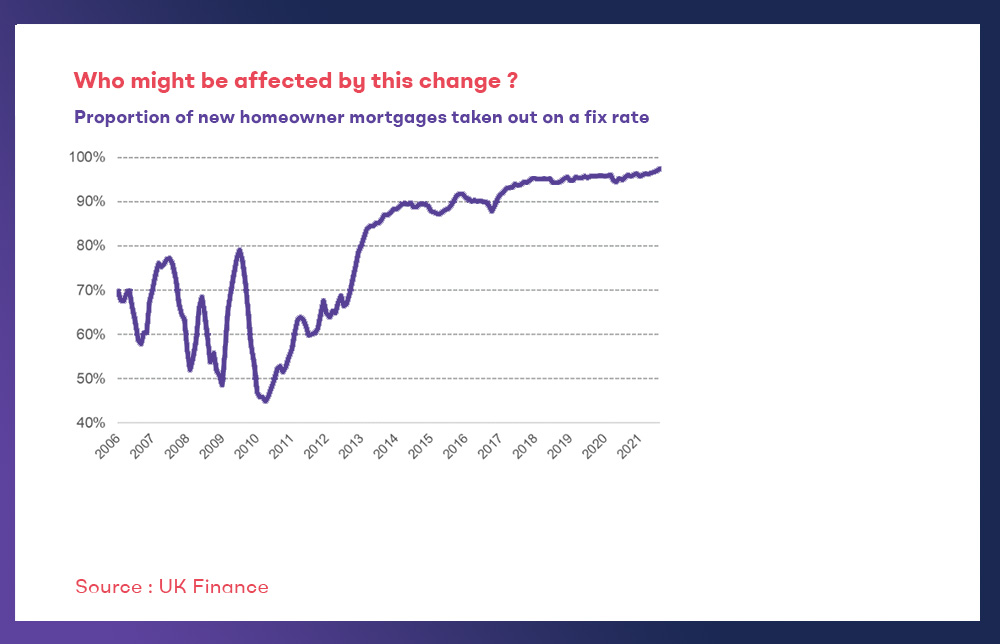

The bulk of mortgage borrowers probably won't see an immediate difference in their mortgage rates as a result of the adjustment in the bank rate. Currently, 74% of homeowner mortgages have fixed rates, and more borrowers are choosing longer-term fixed rates in order to benefit from record low rates. As a result, many borrowers won't notice an immediate change in their monthly payments, which will provide stability over the long term.

These borrowers are more likely to feel the consequences of rising interest rates. There are about 850,000 borrowers who have tracker rate mortgages, and a 0.15 percentage point increase in the bank rate may result in an average increase in monthly repayments of £15.45. Additionally, it's possible that the standard variable rates (SVR) of almost 1.1 million borrowers may increase by an average of £9.58 a month.

The latest hike in the bank rate to 0.25% is the smallest increase since 1989, which is significant to keep in mind while analysing the context. The effect on mortgage rates is therefore anticipated to be minimal, even for those who would be impacted by the change. Overall, rates are anticipated to stay historically low, presenting an advantageous situation for real estate investors.

Rising interest rates can have a significant impact on mortgage rates, which in turn affects homeowners' monthly payments. It's crucial to comprehend the relationship between interest rates and mortgage rates, such as the Bank of England base rate. Mortgages with a standard variable rate (SVR) and tracker rates are two examples of variable rate mortgages that are subject to changes in interest rates directly. Mortgage rates for variable-rate borrowers often climb when interest rates rise, increasing monthly mortgage payments. In contrast, homeowners who have fixed-rate mortgages benefit from stability because their interest rate stays the same for a predetermined period of time regardless of changes in the base rate. They are protected from rising interest rates and given peace of mind as a result. Examining remortgaging possibilities before rates rise further may be advantageous for people whose fixed-rate term is about to expire. In spite of rising interest rates, switching to a new fixed-rate mortgage can provide payment stability. Homeowners can handle the possible effects of rising interest rates on their mortgage rates and financial security by seeking professional assistance and staying up-to-date on market movements.

Rising interest rates mean higher mortgage rates for borrowers, which can have various implications for the real estate market and the wider economy. Higher mortgage rates increase the cost of borrowing and reduce the affordability of housing for potential buyers. They also increase the monthly payments for existing borrowers on variable-rate mortgages and discourage homeowners from selling or remortgaging their properties. The impact of rising mortgage rates on housing demand and supply will depend on how quickly and how much they rise, as well as how other factors such as income growth, consumer confidence, unemployment, and government policies evolve.

From an alternative perspective, it's not all gloom and doom and could be an opportunity to get spectacular deals that, in normal circumstances, may not be available. So if you have money to invest, a little creativity can end in spectacular gains.