The pivotal question for both novice and veteran investors hinges on the choice between single family buy to let homes and burgeoning student accommodations. As this sector experiences unabated growth, understanding the nuanced differences between these two property types has never been more vital.

UK real estate, with its tangible nature and promise of investor autonomy, has maintained its allure, proving resilient and robust through various economic tides. Its magnetism has grown remarkably as the sector consistently outperforms, drawing even more stakeholders into its fold.

In this exploration, we delve deep into the merits and shortcomings of both property categories, arming you with the insights needed for a judicious investment. And for those charting their maiden voyage into real estate, an introductory overview of these property types will serve as a crucial starting point.

Buying real estate properties primarily with the aim of renting them out to students is known as investing in student properties. There are two main ways to invest in student real estate in 2023:

Large real estate companies, investment funds, or property developers are the main owners of purpose-built student accommodation (PBSA) properties. One key characteristic of PBSA investments is that mortgages are often not available for individual buyers looking to invest in these properties. This is so because their properties are generally small in size and do not qualify to have a mortgage on them. This means that if you want to purchase a PBSA property, you need to buy it with cash, covering the entire cost upfront. These are:

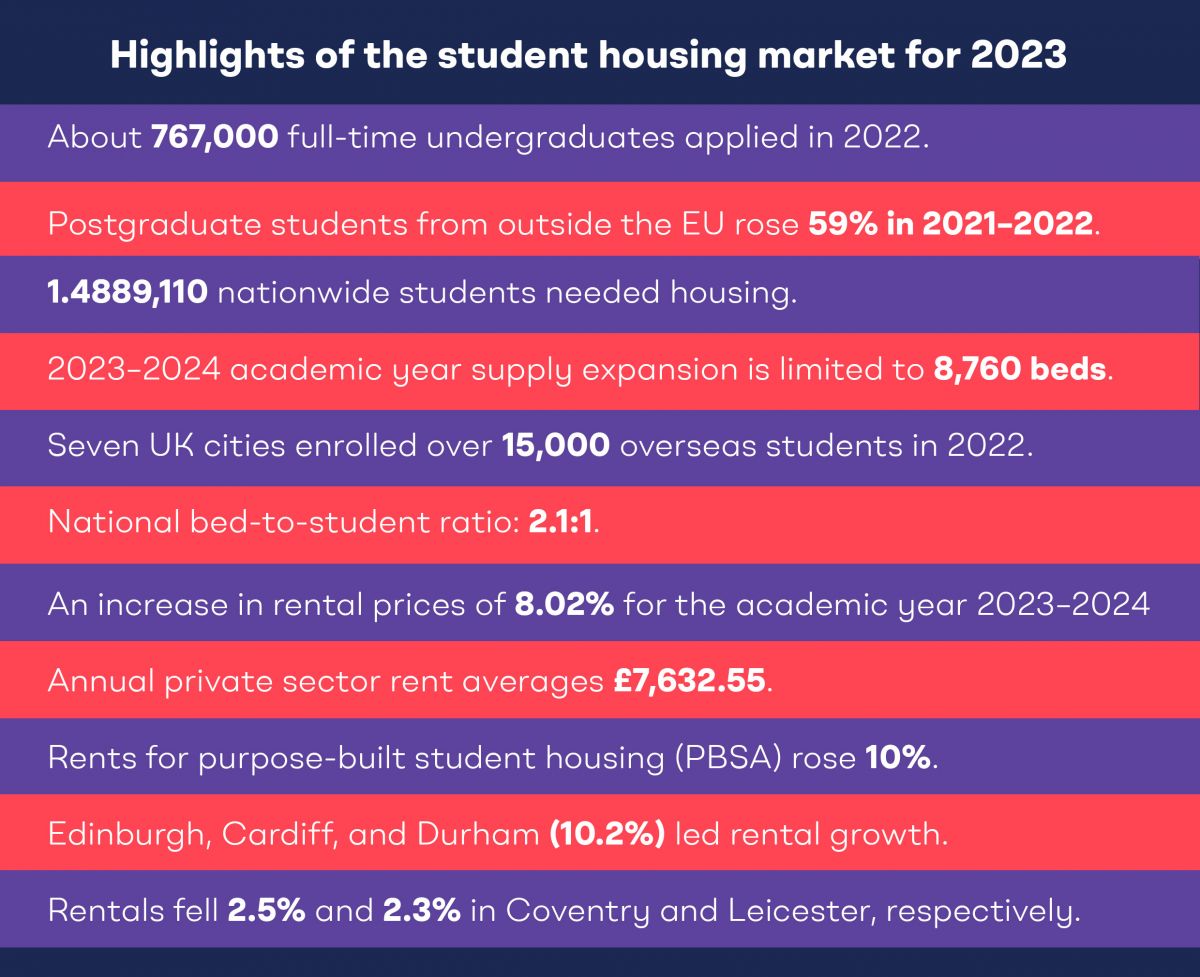

Below are a few highlights for student housing market in the United Kingdom.

Driven by the dual pressures of housing scarcity and a surge in international student enrolments, both HMOs and PBSAs have emerged as a prized asset class within the UK's property investment landscape. With the market exhibiting robust demand and escalating rental yields, investors are presented with compelling investment opportunities.

Below is a glance at the benefits and challenges of investing in both student accommodations vs. buy-to-let properties.

Now, let's have a little detail about these benefits and challenges.

Cost-Effective Entry: Often priced below £100k, student residences offer investors a pathway to substantial, consistent rental income without hefty upfront costs.

Robust Demand: The UK's vast student population ensures consistent demand for accommodation, translating to dependable rental yields with fewer vacancies.

Streamlined Maintenance: Purpose-built student properties typically come with professional management, allowing investors a hands-off approach.

Assured Rental Yields: Some property firms offer guaranteed returns for set periods, bolstering investor confidence and ensuring financial stability.

Stamp Duty Exemption: Typically falling under the £125,000 threshold, student accommodations often benefit from the favourable rates introduced by the Finance Act of 2016.

High & Extended Returns: With yields averaging 11-14% NET over up to 5 years, student housing tends to outperform standard buy-to-let assets.

Turnkey Management: Specialised firms handle all facets of student property management, from tenant sourcing to maintenance, justifying their fees through comprehensive services.

Facilities and Amenities: Modern purpose-built student accommodations come equipped with premium amenities like communal spaces, cinemas, and gyms, making them attractive to both students and parents.

Bullish Market Outlook: Reports from renowned agencies like Savills and Knight Frank confirm's the sector's promise, with strong valuations, post-Brexit investment resilience, and steady growth fostering optimism.

Minimal Vacancies: The persistent high demand coupled with insufficient supply ensures that vacancies in private student housing remain limited.

Constrained Financing Options: Mainstream lenders often bypass student housing projects, necessitating that investors typically have ready cash.

Variable Capital Growth: The appreciation of student properties can be less predictable compared to standard residential assets, necessitating a strategic alignment of investment objectives.

Narrower Resale Market: Exit strategies are confined as these properties are often sold exclusively to investors, diminishing the flexibility seen in the broader residential real estate market.

Navigating High Returns: While high yields entice, depending solely on developer promises is precarious. It's vital for investors to factor in realistic rental expectations against potential costs."

In the UK, the classic approach to property investment has been to acquire residential real estate and lease it to tenants for a return. Below are the advantages and challenges associated with investing in residential properties in the country.

Post-COVID Resurgence: The aftermath of the pandemic lockdowns witnessed a rekindled fervour for homeownership, propelling a significant market surge in 2021.

Record High Valuations: Nationwide highlighted that property values soared to an all-time pinnacle of £254,822 in December 2021, marking the steepest ascent in home valuations in a decade and a half.

Robust Rental Appetite: With December 2021 rents averaging £1,060, closely rivaling the preceding peak of September, and HomeLet quoting an average rent of £1,213 by May 2023, the prospects for high rental income remain pronounced.

Forecasted Momentum: Savills' analytics project a potential price uptick of up to 6.2% in select UK regions by 2027, positioning 2023 as an opportune year for residential ventures.

Investment Lure: Data from the Office for National Statistics pinpointed a 10.3% escalation in average house prices by November 2022, underscoring the market's consistent evolution.

Mounting Requirement: The escalating home prices, challenging many first-time buyers, have bolstered the appeal and demand for rental alternatives.

Tenant Diversity: Residential real estate opens doors to a spectrum of tenant demographics, enabling investors to be versatile in their target audience choices, from families to young professionals.

Capital Appreciation Prospects: Forecasts hint at an 11.7% average price augmentation in parts of the UK by 2027, showcasing potential for significant capital gains.

Premium Rent Readiness: Many young professionals exhibit a penchant for premium rents, especially for posh, strategically located, and architecturally sound properties.

High Property costs: Considering that typical UK property costs are over £250,000 and can even reach £500,000 in major cities like London, it might be difficult to afford, especially for investors on a tight budget.

Steep Property Valuations: With average property prices hovering over £250,000 and spiking up to £500,000 in metropolises like London, affordability becomes a concern, especially for budget-conscious investors.

Risk of Vacancies: Properties in areas with lukewarm tenant demand may encounter periods of vacancy, potentially denting rental earnings.

Significant Initial Capital: The UK's real estate arena often demands a hefty upfront investment, potentially narrowing the spectrum for some investors.

Operational Responsibilities: Property investment is synonymous with ongoing management intricacies, from tending to tenant relations and maintenance to ensuring regulatory adherence.

Market Fluctuations: Despite its general stability, the UK's property market isn't immune to economic tremors, demographic shifts, or interest rate alterations, all of which can sway property valuations and rental yields.

Regulatory Labyrinth: Investors are tasked with decoding and adhering to a slew of regulations, encompassing building norms and zoning laws. Non-compliance can attract penalties.

Regulatory Complexities: Property investors in the UK must navigate a number of restrictions, including construction codes and planning legislation. Penalties and fines may result from noncompliance.

When weighing between residential and student real estate investments in the UK, align your choice with your financial ambitions and circumstances. Consider these essential factors.

Student Property: Typically cash-bought, it offers lower upfront costs, exemption from stamp duty, and furnished units.

Residential Property: While financable, it comes with heftier initial fees including mortgages and stamp duty.

Student Property: A budget-friendly option, prime locations near universities can be as low as £50,000.

Residential Property: Prime city locations start around £110,000, with consistent leasing possibly demanding more.

Student Property: Favoured for consistent, high rental yields, often outpacing inflation.

Residential Property: Valued for potential appreciation influenced by various externalities.

Student Property: If selling isn't immediate, its value appreciation potential is apt for long-term revenue.

Residential Property: Sale considerations should factor in location, demand, and potential growth.

Student Property: Often offers a five-year rental assurance, underpinning consistent revenue streams. With students usually settling their rent upfront and high occupancy levels, income stability is more predictable.

Residential Property: While judicious research can pave the way for reliable residential ventures, investors must brace for potential income dips stemming from challenges like rent default, tenant turnover, and maintenance demands. Especially for those relying on mortgages or viewing rental income as a retirement fallback, preparing for intermittent revenue shortfalls is paramount.

Before diving into either residential or student property investment, it's paramount to align with your goals, carry out rigorous research, and then crystallise your decision. The underpinned elements might be pivotal in navigating your real estate investment choice:

Economic Landscape: A grasp of the prevailing economic trajectory can guide prudent investment choices, particularly in gauging if property values are on an uptrend, downtrend, or plateauing.

Interest Rate Shifts: Monitoring fluctuations in the Bank of England's interest rates is essential, given their direct ripple effect on mortgage rates, consequently influencing borrowing dynamics and property valuations.

Interplay of Inflation and Wage Growth: While inflation might erode buying prowess, robust wage escalation can bolster property demand. Hence, a keen observation of inflation indices juxtaposed with wage growth trends can offer foresight into potential real estate market shifts.

For investors, the choice between student and conventional residential homes in the UK is crucial. Investing in student real estate has several benefits, including low maintenance, strong demand, rental assurances, and lucrative profits. Conversely, there are limitations on financing choices and resale restrictions.

Despite its diversity and profitability, traditional property investing has challenges such as large substantial initial expenditures, probable void periods, and complex regulatory frameworks.

Ultimately, your choice hinges on your risk appetite, investment vision, and fiscal standing. Each avenue offers its own set of merits and challenges. Therefore, align your decision with your distinct aspirations and circumstances.

Act now, invest wisely, and sculpt your property portfolio to mirror your financial aspirations.