Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Image Sources: The Guardian

There are several reasons which were largely triggered by the war between Ukraine and Russia. It has knock on effects on energy and food prices. In addition, the following can be considered as key drivers of UK Inflation in 2023.

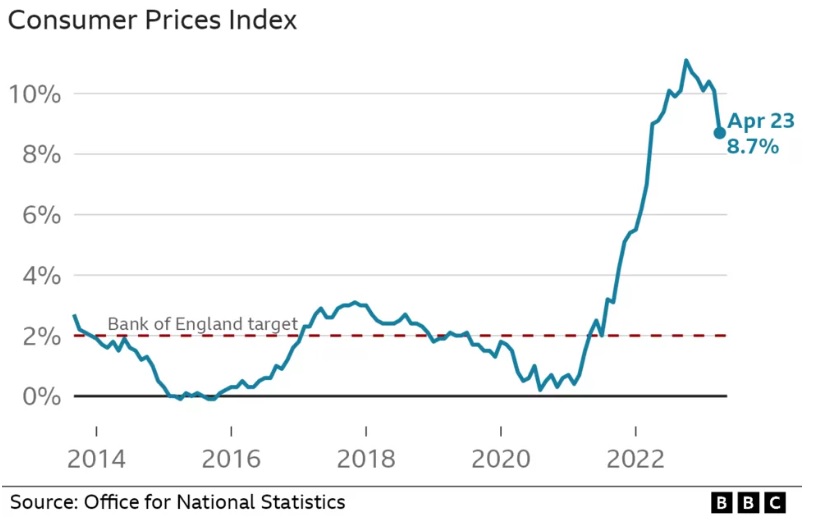

All these factors resulted in the latest figure of inflation growth rate at 8.7% in April 2023 which was 10.1% in March 2023 and 11.1% in October 2022. While inflation seems to have peaked out and seems to be falling steadily, it is a long way from the targeted rate of 2%. The chart below represented by BBC News can explain the UK Inflation Growth more precisely:

Image Source: BBC News (bbc.com)

Inflation in the UK result in higher prices for goods and services, making it more expensive for consumers abroad to buy British products and services. Exports could be impacted as a result, which could negatively impact the trade balance.

Inflation in the UK has an effect on the value of the British Pound against the US Dollar. The Sterling Pound fell from $1.40 all the way to under $1.10 in Q4-2022 but has since recovered and is back above $1.25, albeit still lower than 2021 levels.

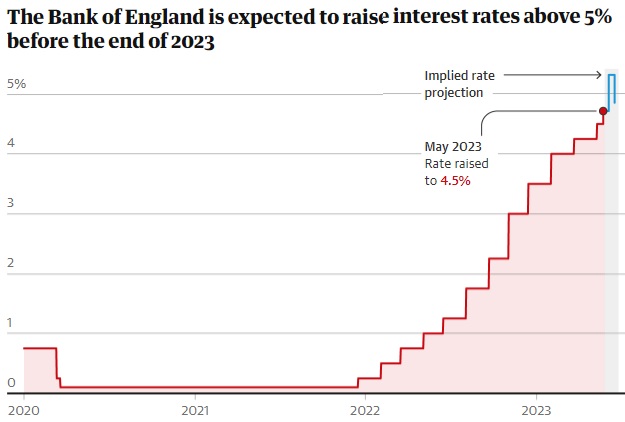

The Bank of England (BOE) must continue to modify its monetary policy, including interest rates, in response to inflation. Changes in UK monetary policy affect interest rate which impacts mortgage payments of millions of British people and further fuels cost of living crisis.

Through a variety of channels, inflationary pressures in the UK could potentially spread to other nations. If the UK is a significant trading partner, for instance, changes in UK prices and demand may have an impact on that nation's economy. Additionally, if inflation in the UK raises inflation expectations internationally, this could have an impact on monetary policy choices in other nations.

There are several measures the UK government has adapted to control the inflation in 2023. It is anticipated that the inflation rate in 2023 will be brought back to 5% by the end of the year. Moreover, the new year could witness a drastic control over the inflation rate and bring it back to the targeted 2% level by the end of 2024. Here is the Bank of England Inflation Forecast 2023 which outline the BoE plans to control inflation.

CPI inflation remained at 10.2% in Q12023 —higher than anticipated in the February Report—remains above the target rate of 2%. Due to the Energy Price Guarantee budget extension and declining wholesale energy prices, a significant decline is anticipated starting in April.

Inflation for food and other goods is anticipated to decline more slowly than in the February Report. Services Inflation measured by the CPI is still high. The rate at which the CPI will sustainably revert to the 2% target is uncertain. The Committee believes that because domestic wage and price setting is still prevalent, inflation risks are biased to the upside.

The medium-term mean CPI inflation profile is at or barely below the 2% target. With only a minor impact from tightening credit conditions brought on by developments in the global banking sector, the global GDP is predicted to grow moderately. Previous increases in the Bank Rate, market interest rates, laxer fiscal policy, and low potential supply have had an impact on the UK GDP.

However, due to stronger global growth, lower energy prices, fiscal support, and lower precautionary savings, growth is anticipated to be significantly stronger than in the February Report. The rate of employment growth has exceeded expectations, and the Bank of England's projected path for unemployment is expected to be lower than in the February Report.

A preliminary estimate revealed that the S&P Global/CIPS UK Composite PMI missed the market consensus of 54.6 in May 2023, falling from the 12-month high of 54.9 in April to 53.9. The most recent reading indicated a significant increase in private sector output that was roughly in line with the series' long-term average. Between the manufacturing and service sectors, different trends persisted. For the third consecutive month, the former reported declining output, which survey participants frequently attributed to depressed order books and customer destocking.

Some businesses also blamed the extra bank holiday in May for lower factory output. Despite numerous reports of a high demand for consumer services, service providers reported a slowdown in business activity expansion since April. Corporate client budget constraints, escalating economic unpredictability, and higher borrowing costs were among the factors cited as barriers to growth. Future-oriented optimism hit its lowest point since February.

According to a preliminary estimate, the S&P Global/CIPS UK Services PMI fell to 55.1 in May 2023 from 55.9 the previous month, falling short of the market consensus of 55.5. Budget constraints among corporate clients, rising economic uncertainty, and higher borrowing costs were cited as growth headwinds. However, the travel, leisure, and hospitality industries have all commented on the resilience of consumer demand. New business growth in the service sector was strong, and foreign orders increased. Meanwhile, hiring reflected rising business demands. On the pricing front, service providers saw the fastest increase in their cost burdens in three months. Prospective business optimism fell in May.

The S&P Global/CCIPS UK Manufacturing PMI was higher than the flash estimate of 46.9 points. Manufacturers were harmed by weak domestic market sentiment, lower new export order intakes, and client destocking, which offset the tapering benefits of improved supply chain performance. However, there was some good news on the cost front, with average input prices falling for the first time in three and a half years.

With such a mismatch between savings rates and inflation, there are very few options for safely preserving wealth, let alone growing it. Investing is one option for savers who want to keep or beat inflation with their money. However, this is far from a risk-free option, with the possibility of capital loss along the way.

As per David Henry, investment manager at Quilter Cheviot, during periods of rising inflation, real assets such as stocks and shares, real estate, and commodities outperform cash and bonds: "We examined the performance of both UK and international stocks during periods of rising inflation since 1970 and discovered that UK markets outperformed global peers during these periods."

This is most likely because the UK market has historically had a relatively high exposure to the energy and commodity sectors. Holding shares in an energy producer is an obvious 'hedge' against the current cost of living crisis." "Protecting against high inflation is difficult for investors," says Rob Morgan of Charles Stanley.

Higher inflation and higher interest rates to combat it have a negative impact on the majority of asset prices."The problem for investors is that a straightforward traditional portfolio of equities and conventional bonds is not inflation resistant." However, he claims that there are a few areas that can help diversify a portfolio while also mitigating the effects of inflation.

These are some examples: Revenues from infrastructure assets are frequently contractually linked to inflation rates. Index-linked bonds that pay an income with an inflation-linked component. Gold, which sometimes does well in inflationary times, especially when interest rates do not rise sufficiently to compensate for stubborn inflation, becomes proportionately more expensive if many investors want to protect their portfolios at the same time.

The year 2023 so far has marked a difficult year for the United Kingdom's economy as inflationary pressures remain. Recognising the negative impact of excessive inflation on the nation's financial stability, the government took a number of deliberate steps to reduce inflationary growth.

Adopting a conservative monetary policy stance, tightening fiscal measures, and establishing tailored legislation to address specific industries experiencing unsustainable price increases were among these approaches. While the success of these measures will require ongoing monitoring and evaluation, the government's proactive approach reflects a commitment to preserving price stability and the UK's long-term economic health.