Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Mortgage affordability trends:

Regional House Price Variations:

Market Activity and Outlook:

The UK will see better growth in some regions than others. According to JLL's latest predictions, Central London, Greater London, and the Midlands are among the key regions for growth. With Central London expected to see a 19.3% increase in property prices by 2027, investing in these growth areas could yield significant returns.

The rental market in the UK is also experiencing growth, making property investments even more appealing. Rental prices have been on the rise, with significant increases predicted for cities like Manchester, Birmingham, and Bristol. JLL forecasts rental growth of over 18% in these cities from 2023 to 2027, driven by regeneration, job opportunities, and high demand.

The imbalance between supply and demand in the rental sector continues to drive up rental prices, making property investment increasingly lucrative. With the private rented sector becoming the second largest sector in the UK, the demand for rental properties is expected to continue growing, creating ample opportunities for investors.

The UK's population is expected to reach 74 million by 2040, leading to a higher demand for rental properties. Additionally, the number of over-50s in the rental market is on the rise, presenting investors with diverse opportunities to cater to different demographics.

The UK has been attracting increasing foreign direct investment (FDI), particularly in regions like the West Midlands. With global businesses expanding their presence across the country, cities like Birmingham and Coventry are experiencing rapid growth and attracting attention from investors worldwide.

The UK property market has historically demonstrated resilience and steady growth, offering investors a stable environment to build wealth over the long term. With experts predicting continued growth in 2024, property investment remains an attractive option for those seeking stability and appreciation.

Favourable borrowing conditions, thanks to the low interest rates set by the Bank of England, are making property investment more accessible and affordable for investors. This presents an opportune time to finance property acquisitions and leverage returns.

Certain regions of the UK are experiencing rising rental yields, providing investors with a steady stream of income. Identifying areas with strong demand-and-supply balances can lead to consistent rental income and enhance the overall financial performance of an investment portfolio.

Therefore, with many challenges still confronting investors, strategic investment in UK property in 2024 presents an opportunity to capitalise on positive market trends and unlock lucrative opportunities for growth and financial success.

It is imperative to diversify your real estate portfolio in order to minimise risk and optimise rewards. Here are some tips for successfully diversifying your real estate investments:

In the realm of UK property investment, navigating through challenges and seizing opportunities is crucial for investors looking to thrive in the market. Despite recent hurdles, there are indications of a gradual recovery and potential for growth in 2024.

Key Insights:

Although there have been challenges over the last 18 months, we anticipate that in 2024, the prospects for returns on real estate investments will improve. Income returns will probably drive overall returns, even though opportunities for capital growth may still be limited. Furthermore, it becomes more likely that real estate investments will yield positive returns when the rate of inflation declines.

Sectoral Divergence: We anticipate that the prominent pattern of performance divergence among various property kinds will continue in 2024. Promising rental growth prospects and increased investor interest position the industrial and residential sectors for success. Nonetheless, performance differences between the office and retail sectors can persist, depending on the calibre of assets in each industry.

Rising Investment Activity: We anticipate an uptick in real estate investment activity in 2024, but a full recovery to pre-downturn levels may take time. Lower price levels observed during the market's downturn phase may delay the return to previous investment volumes in cash terms, despite an increase in activity.

Refinancing Dynamics: As many loans reach maturity in a different interest rate environment, refinancing challenges are likely to remain prominent throughout 2024. A financing gap for borrowers is exacerbated by declining capital prices and rising interest rates, which may result in distressed sales and call for creative ways to close the difference in funds.

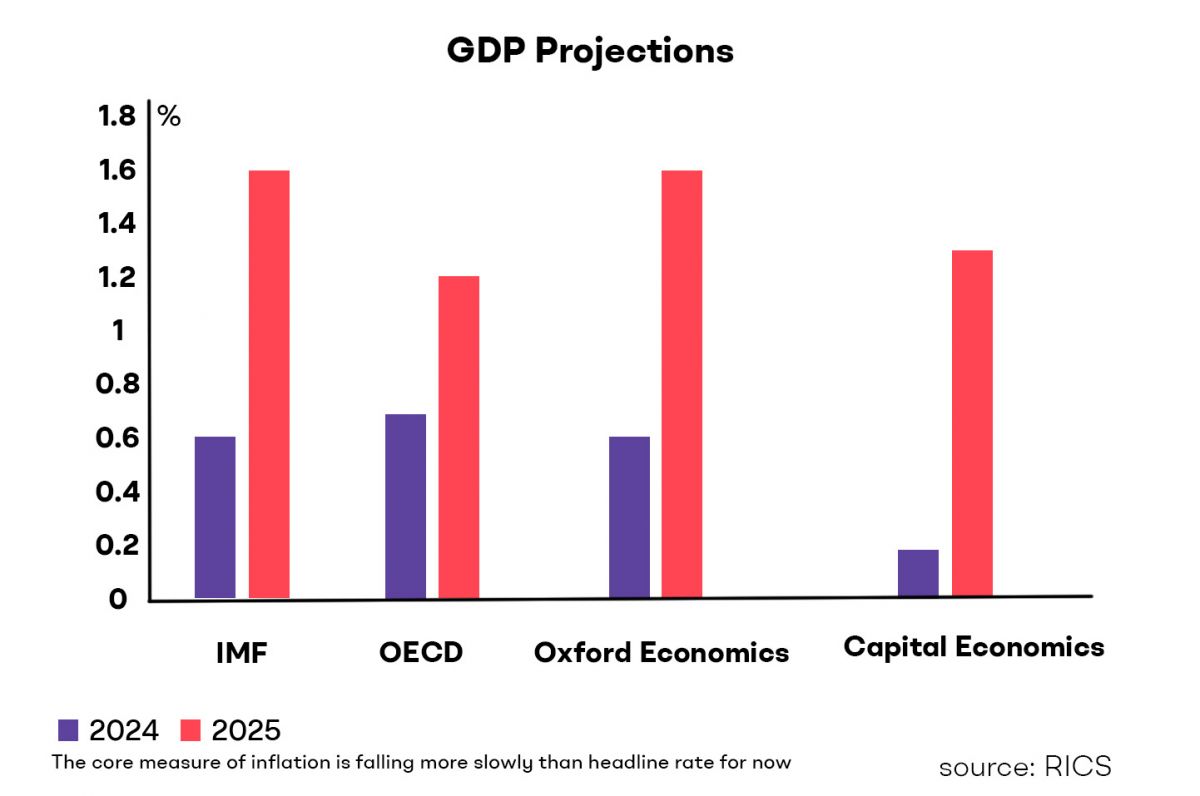

Recent forecasts from the IMF, OECD, and prominent consultancies suggest a subdued outlook for the UK economy in the near term, with modest GDP growth expected for this year. However, we anticipate a slightly stronger performance in 2025.

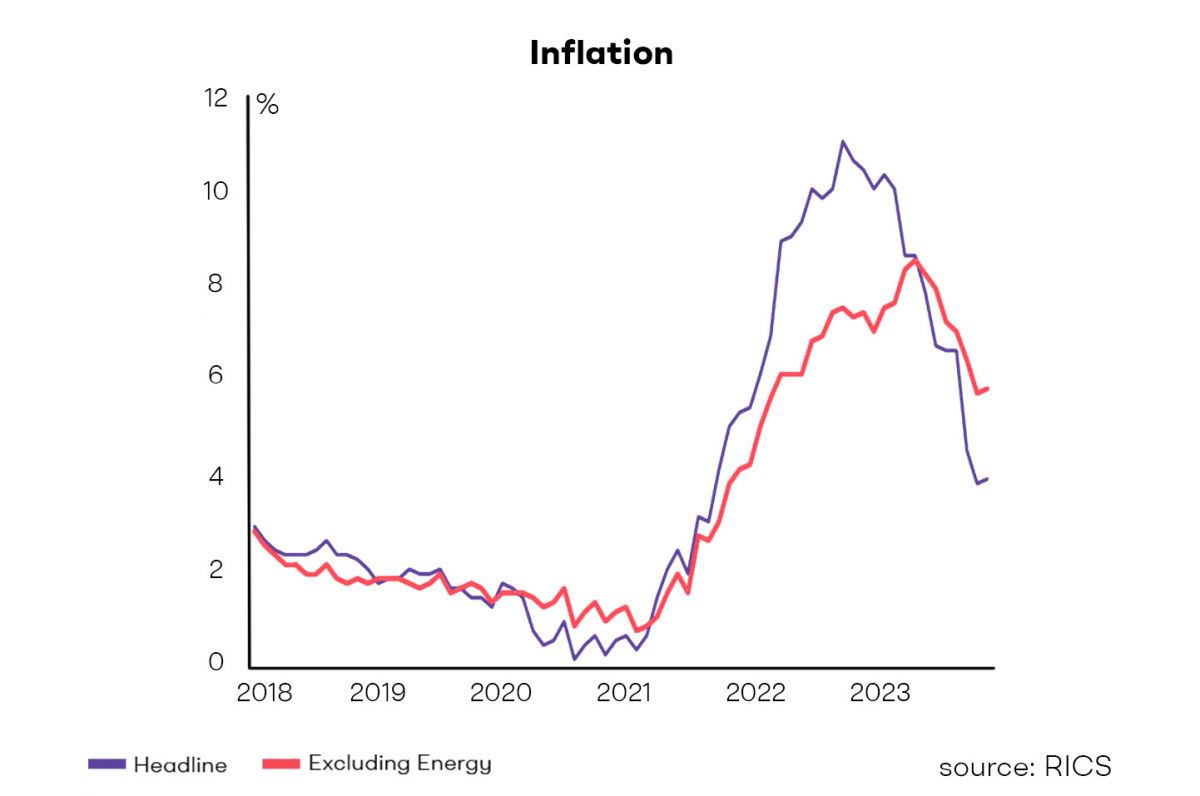

A key determinant of macroeconomic performance is inflation, with the headline rate projected to decline sharply over the coming months, potentially reaching the 2% target by spring. Factors such as lower oil and wholesale gas prices, including a projected 15% drop in the Ofgem energy price cap in April, influence this downward trend.

The Bank of England's stance on interest rates. While some experts anticipate a decline in interest rates, others remain cautious, suggesting that rates may stay above target for the next few years.

Chart 1 illustrates growth forecasts, indicating subdued growth for the current year with a slightly stronger outlook for 2025.

Chart 2 depicts the trend in inflation rates, highlighting the slower decline in core inflation compared to the headline rate.

The fiscal landscape remains uncertain, with ongoing debates about the Chancellor's fiscal headroom in the upcoming budget. Softening inflation may impact tax revenues, potentially limiting fiscal flexibility.

Navigating the landscape of UK property investment requires a blend of foresight, strategy, and adaptability. Despite prevailing challenges and uncertainties, 2024 presents a plethora of opportunities for astute investors to capitalise on emerging trends and unlock the full potential of the market. By embracing strategic diversification, leveraging favourable financing conditions, and staying attuned to market dynamics, investors can chart a course towards sustainable growth and long-term prosperity in the dynamic world of UK property investment.