Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Investors are increasingly drawn towards BTL investments due to the potential for attractive rental yields and a range of other compelling factors. BTL investments with novyy offer the opportunity to generate a regular income stream through rental payments, providing investors with a stable and consistent return on their investment.

The allure of BTL lies in the combination of rental income and the potential for capital appreciation over time, making it an appealing choice for those seeking long-term wealth creation. While specific rental yields vary based on factors such as location, property type, and market conditions, investors can expect competitive returns in the BTL sector.

Furthermore, it is estimated that there are currently 2.3 million landlords in England. The rental market in the United Kingdom is expected to grow by 6.5% by 2025. There will also be 5.8 million individual rental homes available.

According to Zoopla, landlords also saw a sizable increase in rental income of 16.1 percent. London, Manchester, and Glasgow saw the most increases in median rent, totalling £120, over the past year. So, whether you are just starting out as a UK landlord or are an experienced investor, make sure to take note of the following expert advice:

.jpg?1695899288382)

If you're interested in becoming a successful landlord through a BTL investment, these are the top ten things you should know. Okay, so let's begin!

You should investigate possible areas for your BTL venture carefully. Find locations that have high rental demand, convenient access to public transportation, close proximity to essential services, and development potential. Consistent rental income and capital appreciation are more likely in high-demand areas, such as college cities or those with thriving job markets. You can expect high rental returns in metropolitan hubs like Manchester, Coventry, Glasgow, and others.

Estimate the sum total of all expenses that will need to be paid in order to make a BTL investment. You may get a good sense of whether or not renting is profitable by comparing the prospective income with these expenses. Investing wisely requires a thorough examination of one's financial situation.

Having trustworthy tenants is essential for any BTL investor. Include thorough credit checks, criminal record checks, and references from former landlords and employers in your tenant screening process. This can lessen the likelihood of problems like nonpayment, damage to property, or eviction.

Tenant happiness and long-term value are both directly tied to how well a building is maintained. Respond quickly to maintenance requests, examine the property frequently, and keep it in good shape. Tenant turnover can be lowered, tenant satisfaction can be increased, and property value can be safeguarded through proactive property management.

It's crucial that you, as a landlord, know your responsibilities under the law. Maintain familiarity with the most recent tenancy laws, health and safety policies, and licencing standards for rental properties. If you want to keep yourself and your tenants out of legal trouble, you should follow these rules.

Create thorough landlord-tenant agreements that spell out each party's obligations and rights in detail. Get everything sorted out with the lease, the security deposit, the notice period, and the house regulations. A seamless landlord-tenant relationship is possible with a well-drafted agreement that addresses potential points of contention.

It is essential to keep lines of communication open and honest with your tenants. Tenants should feel like their complaints have been heard and issues resolved quickly. Trust is built, misunderstandings are avoided, and a good relationship is formed through effective communication.

If you find yourself with too many properties to handle or not enough time or knowledge to do it effectively, it may be time to bring in the pros. You can put your attention towards growing your investment portfolio or other responsibilities while they handle tenant screening, rent collection, property maintenance, and legal compliance.

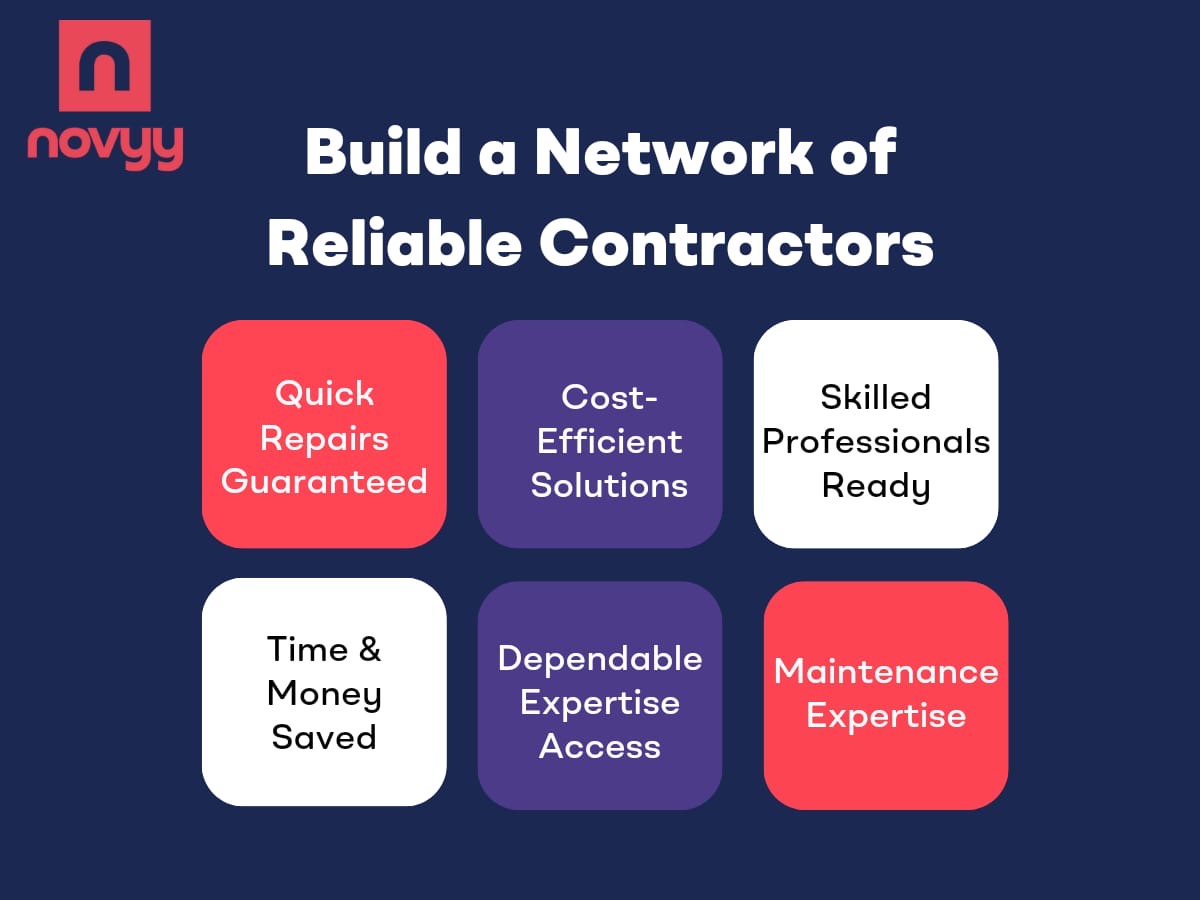

Create a network of dependable contractors, such as plumbers, electricians, and maintenance experts. Trusted contractors on hand, when repairs and maintenance are needed, might help save time and money. Relationships with these experts can help you save both time and money.

Keeping abreast of market developments is crucial to your long-term success in real estate. Always be aware of what's going on in the market, what your rent should be, and what laws have changed. Be willing to alter your investment approach or your portfolio as a result of changing market conditions and evaluate your strategy on a regular basis.

Achieving success as a BTL landlord calls for meticulous preparation, focus on detail, and perseverance. If you follow these ten guidelines, you'll be on your way to better investment returns, happier tenants, and a stellar reputation as a landlord. Real estate investing is a long-term business, so it's important to think ahead and be flexible.

Investors are increasingly drawn towards buy-to-let investments due to the potential for attractive rental yields and a range of other compelling factors. Buy-to-let investments offer the opportunity to generate a regular income stream through rental payments, providing investors with a stable and consistent return on their investment.

The allure of buy-to-let lies in the combination of rental income and the potential for capital appreciation over time, making it an appealing choice for those seeking long-term wealth creation. While specific rental yields vary based on factors such as location, property type, and market conditions, investors can expect competitive returns in the buy-to-let sector.

Furthermore, it is estimated that there are currently 2.3 million landlords in England. The rental market in the United Kingdom is expected to grow by 6.5% by 2025. There will also be 5.8 million individual rental homes available.

According to Zoopla, landlords also saw a sizable increase in rental income of 16.1%. London, Manchester, and Glasgow saw the most increases in median rent, totalling £120, over the past year. So, whether you are just starting out as a UK landlord or are an experienced investor, make sure to take note of the given expert advice.