Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Are you an Indian citizen living in India and seeking to buy a UK Property?

Do you not have resident status in the UK?

If you have answered yes to both of the above, you've come to the right place. This article will assist you in understanding what Foreign National Loans are and how you could use them to buy UK properties.

So, why wait? Let's start with an explanation of what FNL is.

FNL stands for foreign national loans. It is also known as a foreign mortgage or international loan. Essentially, it is a word used when people require loans to purchase property in a country other than where they are ordinarily resident. In layman's terms, foreigners from Asia and the Middle East purchase property in countries like the US and the UK using such a loan. It has some characteristic differences when compared to a traditional residential mortgage. Terms and rates are both different with Foreign National Loans (FNL) as they are deemed to be higher risk.

Many foreigners wish to buy property in the United Kingdom but are unable to do so due to a lack of financing solutions. The biggest roadblock for foreigners is the resident/visa status. Most lenders will only lend to those foreigners who live in the UK – i.e., the ordinarily resident status.

Foreign National Mortgages require sufficient understanding on the part of both lenders and borrowers. There is always a considerable risk, and the borrowers must go through several rigorous processes to obtain this credit.

In the past years, real estate professionals have witnessed that a sizable amount of the UK’s property is owned by foreign investors. A majority of these are commercial properties held by Sovereign Wealth Funds such as the Gherkin in London owned by Qatar Investment Fund. Among retail investors, Hongkong leads the pack by being the largest source of buyers. Here are some of the amazing facts:

In 2022, around 57% of the investments in London are done by Foreign investors.

In addition, the proportion of foreigners in British real estate has risen to 19%.

If we talk about pricey areas, Westminster, Kensington, and Chelsea will undoubtedly be on the list of foreign investors making significant purchases.

Westminster now has an overall total of £11.8 billion property, while Kensington and Chelsea have a value of £10.7 billion.

If we look back 50 years ago then the UK real estate property prices would leave you in thoughts. In 1972, UK properties were averaging about £5,158 only.Inflation-adjusted, this is still a very affordable £49,333 by today's standards.Currently, the average purchaser in the United Kingdom spends £278,436 on a property. That is a cumulative increase of 464%, with annual house price increases averaging 9.3%, or £4,582, over the past 50 years.

Now according to ONS April 2023 data, the median price of UK house stood at £286,000 which is £9000 higher than 12 months ago.

As per the statistics presented by Financial Express in its September 2022 edition, around 3.5% of the properties in the UK are owned by overseas Indian buyers.

Foreign National Loans are mortgage solutions designed exclusively for non-resident individuals who want to buy property in foreign nations. These loans are made available by financial institutions in the host country to meet the specific financial needs of international investors. Now for Indian investors, let’s check what FNL has to offer.

FNL enables Indian investors to invest in the real estate markets of their choice, which may provide superior growth prospects, stable economies, or growing property markets. Diversification can help to reduce risk and improve the overall performance of an investment portfolio. A report from Times of India shows that Indian high net worth investors are willing to invest around £2.9 million to £4.5 million each to buy properties in the UK.

Investing in the UK or in other countries through mortgages allows for diversification of investment portfolios, reducing exposure to regional risks and volatility. A study from the UK Govt. conducted between 2016 to 2018 presented that around 74% households owned their homes by ethnicity.

Indian investors can protect their investments from currency risk by securing FNL in the host country's local currency. Because exchange rates fluctuate, having a loan denominated in the local currency can protect them from potential currency (rupee) depreciation.

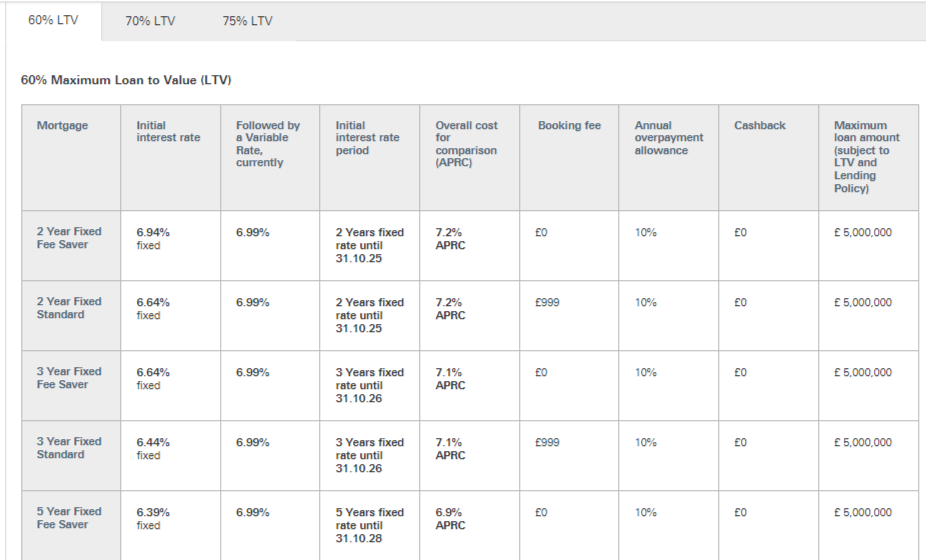

FNL may offer more competitive interest rates in some situations as compared to financing options available in India or from other sources. This can lead to lower borrowing rates and higher investment returns. So, to provide you with an account of interest rates, below is a tabular depiction for your convenience.

Source: HSBC

Distinct countries may have distinct tax regulations and incentives that can benefit Indian investors. Investors in some areas may be eligible for tax breaks on mortgage interest payments or property-related charges, enhancing their cash flow.

Investing in overseas real estate via FNL diversifies an investor's asset allocation, lowering reliance on a single market and spreading risk. During economic downturns or severe market situations, this diversification technique can be especially beneficial.

FNL's international real estate holdings offer Indian investors a useful asset for wealth preservation and long-term financial planning. Furthermore, real estate holdings in economically stable countries can provide a safe haven during times of geopolitical or economic upheaval.

Before borrowing, foreigners must make themselves fully aware of the requirements of the lender. It is critical to select the correct lender for overseas mortgage loans. There are very few lenders who will finance foreigners, and even fewer who will finance non-resident foreigners. To obtain these loans, you must go via a mortgage broker who will assist you in choosing the best lender for your situation. The broker has the relevant professional license, experience, and expertise so that you do not have any difficulty in obtaining these mortgages. Or choose Novyy – the unique approach of financing SPVs for non-resident foreigners.

For Indian overseas investors looking to capitalise on global real estate prospects, mortgages have emerged as a valuable tool. FNL has shown to be an excellent tool for Indian investors to acquire foreign lands and safeguard their financial future by giving access to international markets, currency diversity, tax advantages, and risk mitigation.

However, in order to maximise the benefits and handle the problems associated with overseas real estate transactions, investors must practise due diligence and seek professional counsel.

Please Note: Nothing on this website should be construed as tax advice. Information here is meant to be a general overview only and Novyy does not provide tax advice. Please consult your tax professional for further information on any matters which may be relevant to your individual tax circumstances.