Fractional ownership is transforming UK property investment, offering a modern alternative to traditional buy-to-let models. This approach allows investors to collectively own property, sharing costs and benefits. It democratizes access to real estate, making investment more accessible and spreading risk among participants.

This model's appeal lies in its ability to open up the property market to a wider audience, allowing for portfolio diversification and mitigating investment risk. However, it's not without challenges, including structural considerations and managing co-owner relationships.

As we explore fractional ownership, it's clear this innovation is more than an alternative strategy; it's reshaping real estate investment in the UK, making it more accessible and adaptable for the future.

Investors are increasingly interested in the idea of fractional ownership properties , which allows them to share a property. Unlike timeshares, fractional ownership gives individuals tangible ownership rights to a portion of the property in the form of shares held in an SPV each owning the property and gains limited to the share value.

Fractional ownership is reshaping property investment, introducing a collaborative and flexible model that gives investors tangible equity stakes through an SPV, directly linking their investment to the property's market value. This approach diversifies investment opportunities, from owning a piece of luxury real estate to tapping into high-demand areas like student housing and holiday lets, promising enhanced rental yields and long-term capital growth.

This shift is redefining property investment, appealing to both seasoned and new investors with its accessible entry points, streamlined management, and broad diversification potential. It's not just an alternative to traditional buy-to-let but a complementary strategy that simplifies property portfolio expansion without the hassles of full ownership.

Enhanced by professional management services that take the weight off direct property management and curb rising costs with economies of scale, fractional ownership is becoming a pivotal growth and profitability avenue in the evolving property market. This isn't just a fleeting trend; it's a transformative movement, setting new standards and expanding opportunities in the UK's real estate landscape.

Fractional ownership is indeed gaining momentum in the UK as an innovative and accessible investment model, particularly in the real estate sector. It is redefining the real estate investment landscape, offering a practical solution to the high entry barriers of traditional property investments. This innovative model, which allows multiple investors to share the costs and benefits of high-value assets, is becoming increasingly popular. Its rise is driven by its affordability and the diversification opportunities it presents, making property investment accessible to a wider audience. Exploring Popular

Houses of Multiple Occupation (HMOs): This offers profitable investment prospects, particularly in university towns and smaller cities. Renting rooms to students or young professionals can boost rental yields for investors. Due to relaxed change-of-use restrictions, property investors looking for higher returns can now convert empty high-street units into HMOs.

Purpose-built student accommodation (PBSA): A popular option in student housing in the UK is purpose-built student accommodation (PBSA), it presents an attractive investment opportunity because of increased demand from domestic and international students. Investors benefit from purpose-built student residences with modern facilities and social spaces. Student housing remains an attractive investment for property developers due to the ongoing student influx.

Holiday Let Investments: Due to increased domestic tourism and staycation preferences, holiday lets have become increasingly popular. Holiday lets have higher daily and weekly rates than buy-to-let rates, giving landlords bigger profit margins. Holidays let landlords get tax breaks and capital gains despite furnishing costs. Working with flexible lenders simplifies the investing process and provides holiday loan financing choices.

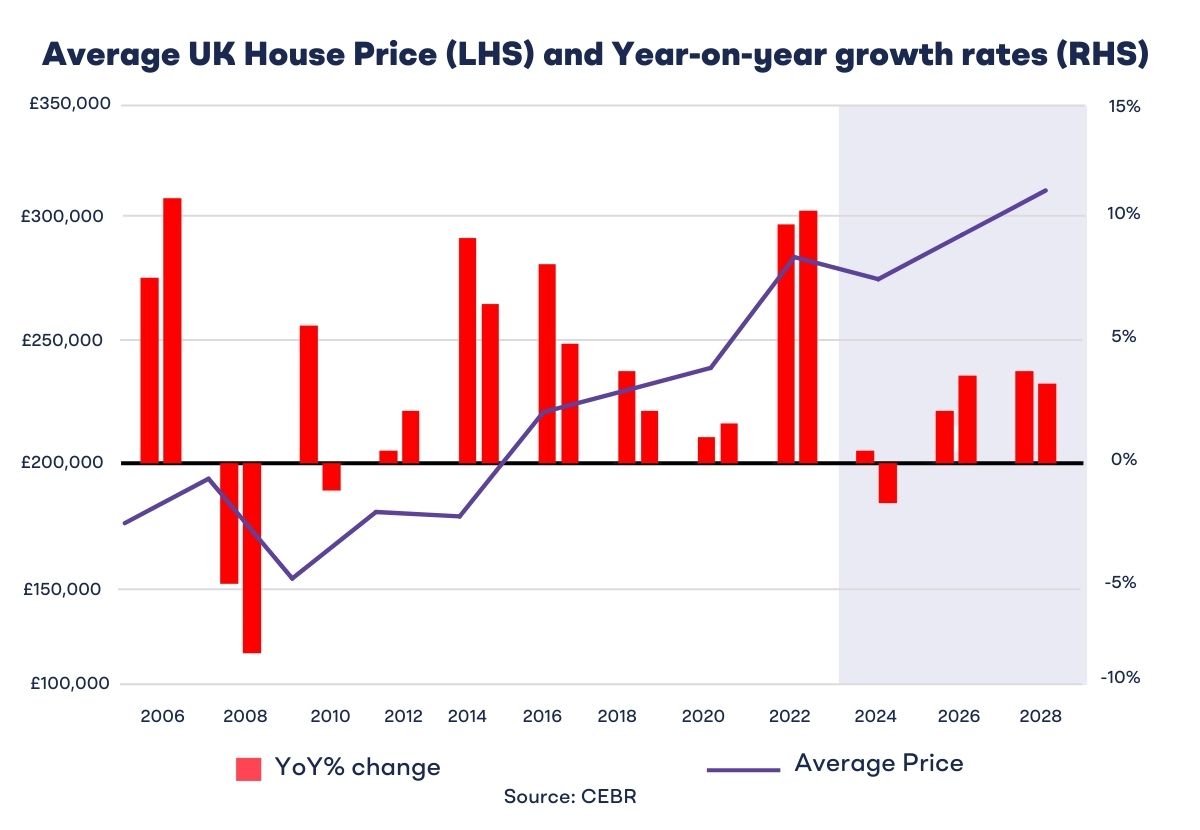

In 2024, the UK property market will show signs of recovery. According to Rightmove, asking prices have risen by 0.1% compared to the previous year, marking the first annual increase in six months. Demand from buyers has strengthened, with a 16% rise in agreed sales compared to the previous year. However, caution remains due to elevated mortgage rates, despite expectations of potential rate cuts by the Bank of England. Other indicators, such as increased properties coming onto the market and buyer inquiries, also point to growing activity. Overall, while there are positive signs of improvement, there is also cautious optimism amid ongoing economic uncertainties.

Here’s a look at the house price movement in the UK across several years.

Several key factors will shape the future of the UK property market:

Interest Rates: With the Bank of England expected to drop rates, lenders may lower interest rates. This may increase demand, boosting housing prices.

Affordability: Potential buyers are concerned about affordability, but a drop in mortgage rates and a rise in real salaries may increase demand.

Regional differences in house prices and market performance are essential. Coventry, unlike London, has grown or rebounded. Investors and purchasers must understand geographical differences.

The rental market has remained strong, with prices rising at differing rates across regions. This trend emphasises rental property investing.

In this changing context, fractional ownership offers a viable property opportunity. This strategy lets investors own a piece of property, lowering entry barriers and diversifying portfolios.

Fractional ownership is ushering in a pivotal shift in the realm of property investment, positioning itself as a vibrant contender against the backdrop of traditional investment avenues. By injecting greater accessibility, diversification, and flexibility into the UK's real estate landscape, it's carving out a new future for investors and stakeholders alike.

From accessing premium locales to broadening investment horizons and enjoying streamlined ownership experiences, fractional ownership presents a comprehensive palette of opportunities for those navigating the evolving dynamics of the property market. As this model continues to redefine the contours of real estate investment, it prompts us to ponder the possibilities it holds for reshaping our approach to property ownership.

What do you think? Is fractional ownership the future of real estate investment, or just a fleeting trend in the vast landscape of investment options?