Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

A House in Multiple Occupation, or HMO, is a house where three or more unrelated people live together and share common areas like a bathroom and kitchen. Larger HMOs in England and Wales that accommodate five or more individuals from various homes are required to obtain a licence. Licences are valid for up to five years and must be renewed. A "fit and proper" manager, compliance with safety regulations, and suitability for the inhabitants are all prerequisites for obtaining a licence. Failure to obtain a licence can result in substantial fines, including the possibility of an unlimited fine.

A local tax called council tax is used to pay for the services that local councils deliver. It includes a range of city services like trash collection, street lighting, street cleaning, road maintenance, and vital community programmes like "Meals on Wheels." It also helps to finance services provided by the Greater London Authority, which includes the police, fire department, and other citywide agencies.

When a home is designated as a House in Multiple Occupation (HMO) for the purposes of this particular tax, tenants are exempt from paying council tax. Although there is frequently overlap, the Housing Act of 2004's definition and the determination of an HMO for Council Tax purposes may differ.

For Council Tax reasons, bedsits, homeless hostels, and nurseries are examples of HMOs. If a property was built or later altered to accommodate numerous families, even with just one occupant, it can still be considered an HMO if the renter or licensee is only allowed to inhabit a portion of the property.

The Council Tax (Liability for Owners) Regulations of 1992 outline two tests that determine whether a home qualifies as an HMO for Council Tax purposes. It's enough to pass even one of these tests.

This test applies if more than one household occupied the property when it was first constructed or converted. Features such as extra cabinets, separate bedroom lock fittings, and private amenities for tenants like kitchenettes, bathrooms, or showers could be signs of this. In these situations, the house is probably exempt from council tax because it is an HMO, and renters are not responsible for paying the tax.

When a property is inhabited by one or more people, each of whom is a tenant or has a licence to occupy a specific portion of the property, the second condition is met. Although it may be stated in the tenancy or licence agreement, the tenants are not always required to pay rent. If the occupants are only accountable for a portion of the home's rent or have access to shared amenities but not all of the bedrooms, the property may qualify as an HMO for Council Tax purposes, exempting the tenants from paying the tax.

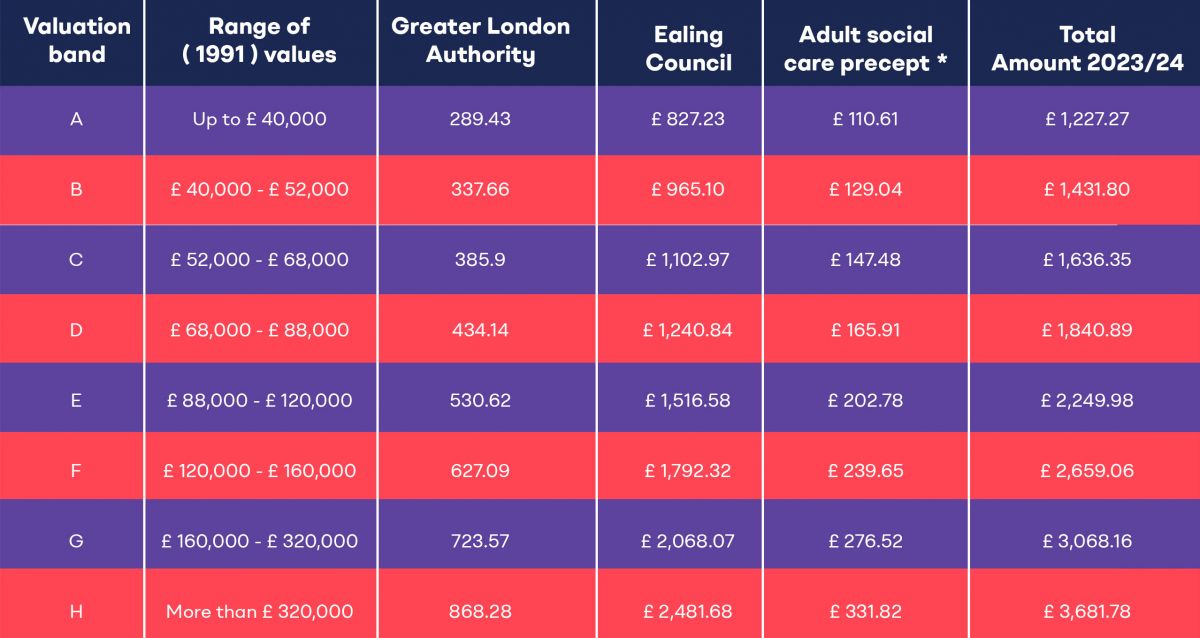

The Valuation Office Agency (VOA) assesses your property's worth, which is used to calculate council tax payments. The estimated property value as of April 1991 determines which of the eight council tax bands the VOA places a property in.

An illustration of various bands and the corresponding tax values may be found below. Find Your Band here.

Depending on the unique features of the property, council tax banding for HMOs might be a complicated procedure. When it comes to Council Tax banding for HMOs, the government has two options in mind:

Option 1: Modifying the Council Tax (Chargeable Dwellings) Order 1992 is one strategy. This would necessitate listing officials treating an HMO as a single property when evaluating it. As a result, HMOs would be regarded as a single property for Council Tax purposes, with the exception of rare situations in which the HMO includes independent living quarters.

Option 2: As an alternative, the government might amend the Council Tax (Chargeable Dwellings) Order 1992 by designating HMOs as single dwellings under Section 3(5) of the Local Government Finance Act 1992. In a similar vein, this strategy would result in a single Council Tax category for HMOs, with certain limitations.

Local governments compute council tax on an individual basis for HMOs. Here are some instances of how HMOs' Council Tax is calculated:

Little or No Adaptations: A single Council Tax band is sometimes applied to the entire house when tenants share common rooms and there are few to no modifications to the HMO, such as locks on bedroom doors.

Modifications to Individual Rooms: Even though some amenities are shared, HMOs with modified individual rooms—such as adding kitchenettes or en suite bathrooms—may be granted distinct Council Tax bands for each room. For landlords, the Valuation Office Agency (VOA) can be a bit unpredictable because of its inconsistent methodology.

Purpose-Built HMOs: In most cases, council tax purposes do not mix purpose-built HMOs. For every interior unit on the property, an assessment is done.

Please be aware that the VOA's assessment of Council Tax bands varies for various HMO properties, making this a complex area of law. It is therefore best to consult an expert while working on HMO projects.

Local authorities in England have set the average Band D council tax at £2,065 for the fiscal year 2023–2024. This represents an increase of £99, or 5.1%, above the £1,966 number from 2022–2023. It is crucial to remember that this sum includes all precepts, including parish and adult social care precepts.

The order of responsibility used to calculate Council Tax liability is specific. This hierarchy must be followed in order to determine who is responsible for a property:

Both landlords and tenants in the UK must take into account the Council Tax assessment of shared housing units. It's critical to understand your responsibilities because larger HMOs are subject to particular rules, and there is a hierarchy of liability that establishes who is accountable for payment. The value of the property as of April 1991 is used to calculate Council Tax bands. The valuation process for HMOs can be complicated because it depends on things like self-contained units and modifications. Know more about HMO fractional ownership and decide if this is the right choice for your next real estate investment.

It is essential to comprehend these rules in order to have a seamless and legal tenancy experience. It is imperative for both tenants and landlords to be aware of their Council Tax responsibilities.