Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

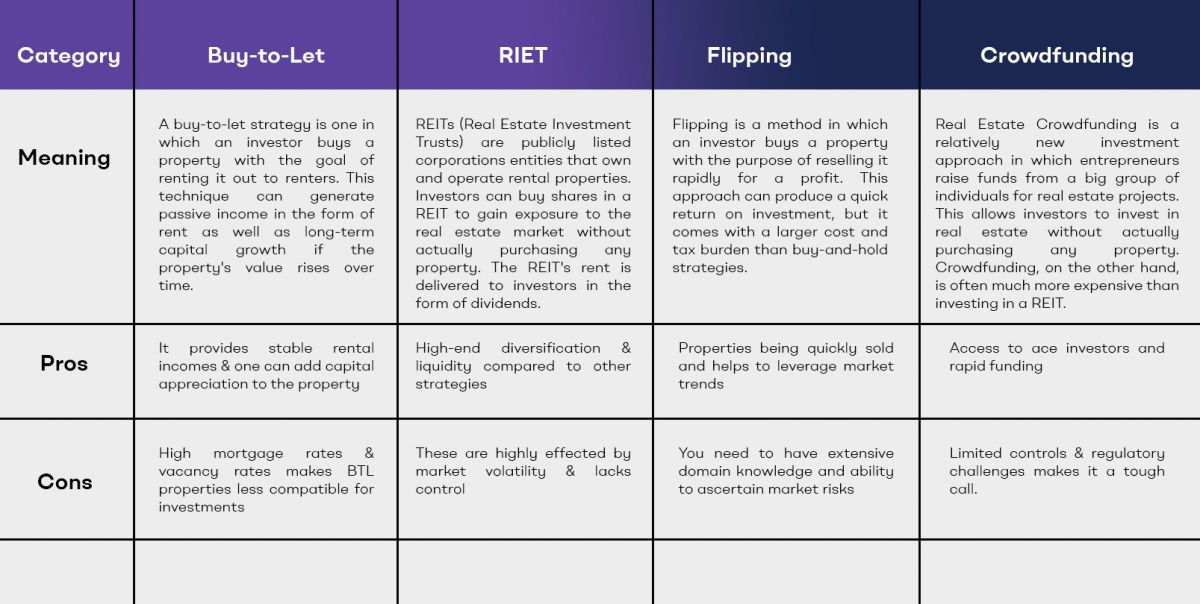

A buy-to-let property investment is one in which an investor purchases a property solely for the purpose of renting it out. The investor earns a monthly income from the rent, and the property's value should rise over time. This plan would provide the investor with both short-term income and capital gains over the long run. Traditionally, BTL was marketed as a low-risk way to invest. It is normally seen as an excellent strategy to accumulate a retirement nest egg.

BTL is a dynamic financial vehicle that propels people into the role of landlords. Investors who become landlords not only enjoy the prospect of continuous rental income but also the ability to construct a tangible real estate portfolio. This investment opportunity allows individuals to actively participate in the growing rental market, capitalising on the need for high-quality homes while cultivating a long-term wealth-building approach.

There are various forms of btl properties like residentials rented to single family, student accommodations like HMO, Multi-units for students and office workers, and Commercial BTL properties like flats rented above the shops.

Following the summary, let's look at the benefits and drawbacks of BTL investments. Let's get started!

BTL properties offer numerous benefits, making them an attractive investment option for wealth creation. Not only this, but it makes real estate investment more stable and profitable. Here are a few pros of BTL property investment:

Rental income is the returns on your investment that you are likely to get from the BTL investment. Rent payments from tenants provide an uninterrupted stream of income for BTL homes. This income stream provides financial stability and can be used to generate long-term passive income. A general analysis says that portfolio landlord are getting as high as 6.7% yearly rental income whereas single property owners are churning around 5.5% yearly

In terms of financial returns, BTL homes frequently outperform other investment options like equities and bonds. The yield on a rental property is the yearly income divided by the property's valuation, which is 5% in the UK in 2023.

When property prices rise somewhat or significantly, capital appreciation occurs. Until 2022, the UK had seen record high property prices, resulting in 3% to 5% capital appreciation on UK BTL properties.

Because there are no such increases in the investments made by seasoned investors or landlords, rental properties will always be in demand. It was discovered that rental property availability was 8% greater annually by the end of the first quarter of 2023.

Here are a few downsides to consider before investing in BTL houses. Let's get this party started!

BTL investments with novyy face volatility and uncertainty in the property market, with fluctuations in prices, rental demand, and government regulations. The UK's financial crisis saw an average 3.5% property price fall in June 2023, the largest since 2009. These downturns can significantly impact the profitability of BTL investments, affecting property values, rental demand, and yields.

UK government measures, such as the 3% Stamp Duty Land Tax surcharge and reduced mortgage interest tax relief, have impacted BTL investments, increasing costs and reducing returns for investors.

The rental market is primarily relied on in BTL ventures, and one of the disadvantages is the danger of rental market saturation. Certain locations and cities in the United Kingdom, particularly those with dense populations, have seen an oversupply of rental houses. For example, in 2023, three regions saw a double-digit decrease in voids, such as:

North East: -16%

North West: -15%

West Midlands: -21%

These void % are impacting the overall profitability of BTL investments.

Investors should consider maintenance and management costs in BTL properties, as they can accumulate over time and impact profitability. Landlords incur management fees, ranging from 8% to 15% of rental income, which can reduce net returns.

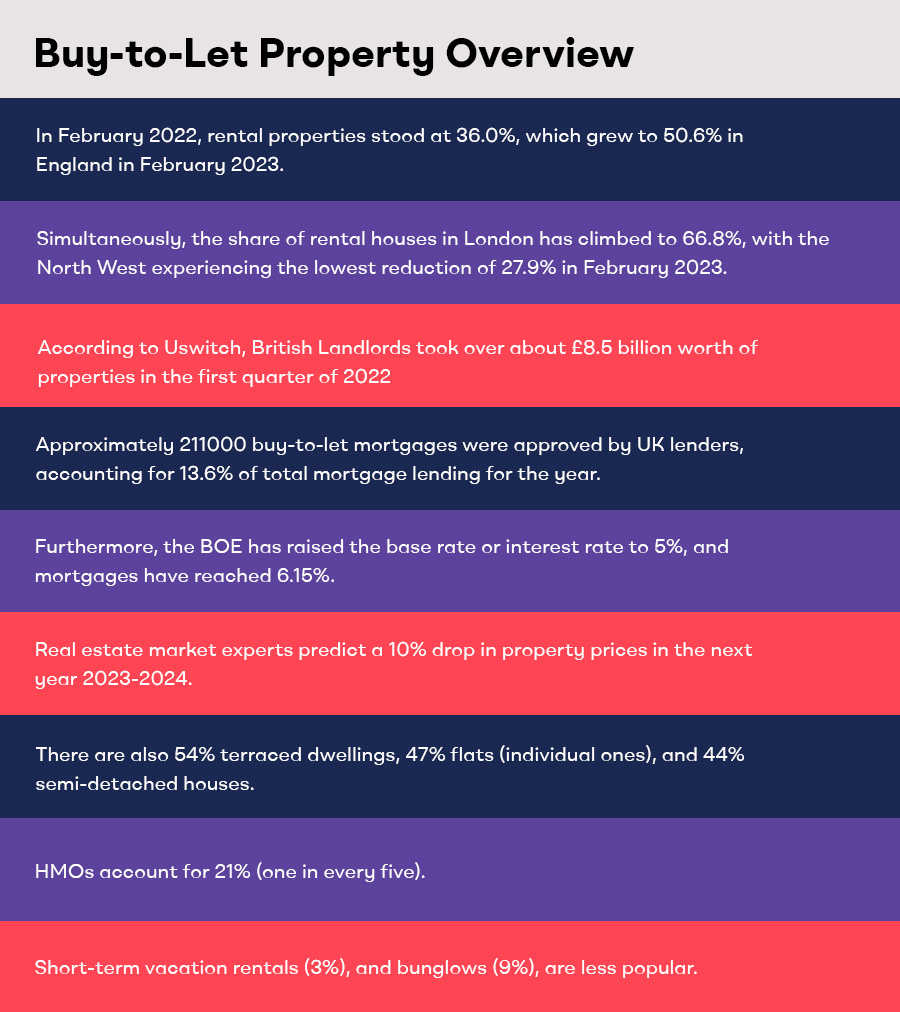

According to Zoopla data, rentals have risen by £115 over the last few years to a median of £1,051.

Rents are also expected to grow considerably as a result of the housing market's disparities in demand and supply.

Furthermore, the demand for rental houses has increased by 142% over the preceding years.

Many investors are going to take a step back because house prices are expected to decline by 5% the following year.

The mini-budget had a significant impact on the BTL lending market, lowering the number of products offered to 988.

Lenders, on the other hand, are now returning with over 1,400 accessible products.

The median cost of a two-year fixed-rate mortgage for a BTL investment has increased from 2.94% in January to 6.76% in the present.

Approx. 2% is the outcome of the BOE’s borrowing cost increment.

According to Zoopla's most recent data, the number of interested purchasers has plummeted by one-third since the launch of the tiny budget.

Most crucially, house prices are predicted to fall by 5% in the next year.

It will be increasing demand for rental properties and providing investors with a consistent source of income.

The government is once again working hard to overcome the economic crisis and stabilise the UK real estate market in the coming years.

It is ready to incorporate the Rental Reform Bill.

In order to provide quality homes to the tenants, the bill has been sanctioned and will cover around 21% of properties to be modified according to it.

Energy Performance Certification (EPC): The EPC must have a minimum rating of E, unless the property is exempt or has a valid exemption certificate.

Landlord licensing: Landlords should check with their local authority if they need a license and what the conditions and fees are.

Gas safety: Landlords must ensure that all gas appliances, fittings, and flues in their properties are safe and well maintained.

Electrical safety: Landlords must ensure that the electrical installations in their properties are safe and suitable for continued use.

Fire safety: Landlords must comply with the fire safety regulations for their type of property and tenancy.

Legionella risk assessment: Landlords have a legal duty to assess and control the risk of exposure to legionella bacteria in their properties.

Right to rent: Landlords must check that all adult tenants have the right to rent property in the UK before they start a tenancy.

Keeping up to date with BTL laws can be difficult due to its ever-changing rules and restrictions. Here are a few ways:

Joining a landlord association, subscribing to newsletters, blogs, podcasts, or magazines.

Following reputable sources such as the UK government, Health and Safety Executive, ICO, or Tenancy Deposit Scheme.

Consulting with a professional adviser to navigate complex and changing regulations are all ways to stay informed.

These sources can provide legal advice and rights, as well as compliance guidance.

Furthermore, speaking with a solicitor, accountant, or letting agency can assist you avoid traps and penalties caused by noncompliance or ignorance of the law.

There is no definite answer to the question of which places in the UK are the greatest for BTL investing, as different areas may suit different investors based on their budget, strategy, and aspirations. However, some alternative methods for identifying the best locations are as follows:

Consider the rental yield, which is calculated by dividing the annual rent income by the property value.

A higher rental yield equates to a greater return on investment.

Blackpool, Burnley, Newcastle upon Tyne, Barrow-in-Furness, and Manchester have some of the highest rental yields in the UK, according to statistics from money.co.uk.

Examining house price growth, or the increase in the worth of a property over time.

Higher housing price rise implies greater capital appreciation.

According to Zoopla data, some of the areas in the UK with the highest house price growth are Bristol, Cambridge, Oxford, Liverpool, and Leeds.

Coventry is another name that gives highest rental yields upto 6%.

For various reasons, BTL investing can be an excellent way to build wealth over time.

It can offer a consistent and passive income from rent that can cover the costs of owning and maintaining the property while also generating a profit.

It can provide capital appreciation, or an increase in the value of a home over time, particularly in places where there is a high demand for and a limited supply of housing.

It can benefit from leverage, which is the utilisation of borrowed funds to purchase a property worth more than the cash invested.

This can boost returns on investment and enable investors to purchase several properties with less capital.

Property is a distinct asset class than stocks, bonds, or cash, thus it can help diversify a portfolio.

This can minimise the portfolio's overall risk and volatility while also improving its performance.

It may provide tax benefits, such as the ability to deduct certain expenses from rental revenue, claim mortgage interest relief, or use a limited company form to decrease corporation tax.