Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Over the past few decades, the BTL sector has achieved many historic milestones. This begins with Margaret Thatcher's tenure as British Prime Minister, in which she introduced significant reforms in the field of home ownership. The origins of the Buy-To-Let sector goes back to the 1970s and 80s when the Conservative Government introduced the Right to Buy policy, which eventually led to the first established mortgage product in 1996. Since then, a variety of game-changing factors have resulted in the current thriving Buy-To-Let market. With approximately 4.4 million households in the private rental sector in the UK in 2021, tenant demand is stronger than ever before.

The growth in remote working as a result of the pandemic has eased affordability issues while the number of people looking to rent rather than buy a home has soared. It is customary to look at buying a property that you live in as a form of investment and, depending on the length of time that passes and the amount that the property's value increases, to benefit from it. Our capacity to live in more than one house, however, is limited. The purpose of Buy-To-Let schemes is to purchase a property with the intention of renting it out for a profit. The goal of such an investment is to generate income through both growth in the property's value as well as rental income that exceeds the loan payments and expenses. The upfront deposit payments are recorded at an average of £281,000. This represents an increase of £31,000 over last year's average in the UK alone. A deposit of at least 5% of the property price is required - however, the average house deposit for a first-time buyer in the UK is approximately 15%. The greater the deposit, the lower your mortgage interest rate and the smaller your monthly payments will be.

In the case of a property valued at £300,000 with the requirement of a 25% deposit, the cost would be an upfront of £75,000 plus costs & fees which could be another 10%. Certainly, not everyone has these large sums of money to spend on a property purchase in order to earn a decent rental return. Investors who have just begun their careers or who have been investing in real estate for many years will immediately recognise the advantages of this investment strategy, thus demonstrating that the investment process in this asset class should not nor will not cease anytime soon. With the recent outbreak of Covid-19, more panicked buyers have upsold their properties sooner than expected, causing a huge imbalance between supply and demand. A property transaction can, of course, be a significant financial commitment as well as a wide variety of duties that extend well beyond the decor.

Here at Novyy, we are improving ways in which we can make a positive impact on your property investing journey.

The traditional practice of BTL

As we have always known, Buy-To-Let properties make for an excellent investment, as they allow us to increase our monthly income while investing over the long term. To begin the process of building our position on the property ladder, we must first understand that traditional Buy-To-Let investing is cumbersome.

Property Search - Property hunting can be painstaking. Getting the right property at the right price is probably the toughest part of the journey. More often than not, property prices are stated higher than the fair market value, which usually becomes visible when one takes up the valuation exercise. Novyy eliminates this from your checklist by having deals ready-to-go. However, if there is something on the market that you like, we are happy to get it on our platform too but we will be as strict with them as we are with our general deal flow to ensure it meets our standards.

Placing a Deposit - Placing a deposit establishes your commitment to the purchase once you have found the right property, and it becomes part of the contract. This can range from 5 to 15%. Here again, Novyy has already done this with the Seller and what you see on the platform is a ready-to-go deal. You can hit the Subscribe button if you like a deal, or buy fractions via our Portfolio option.

Mortgage hunting - This is a time-consuming step for certain, but one that is well worth the effort. Often accessed through independent financial advisors (IFAs), mortgage brokers, or lenders - here you will also find additional mortgage sorting fees, which include broker, booking, and valuation fees. However, Buy-To-Let mortgages are largely unavailable unless your current income stream can support the interest payment. With Novyy – you don’t need to worry about this, as we fund the mortgage via our institutional funding, and this underwriting is done even before you get to see a deal on our platform.

Financial Compliance - Buy-To-Let properties are most efficient when held in Ltd. Companies which means you need an accountant who will set it up for you and ensure you are in compliance with the ongoing compliances and tax regulations. With Novyy – this is all on us. You need not worry!

Legal costs - You will need a solicitor who will arrange conveyancing, due diligence, and payment of stamp duty etc. At Novyy, our all-in administrative fee charged to the asset’s acquisition cost includes all professional expenses payable to third parties.

Ongoing costs - You are solely responsible for the maintenance of the property you purchase. The ongoing fees will cover the maintenance, letting agents, accountants, income tax, landlord insurances, etc. This is not the case when you buy fractions on Novyy. It is our responsibility to undertake all ongoing costs and compliances.

There is a lot on this list, we know. While attempting to balance all of this and do right by your day job, can be quite a daunting task. That’s why we are building Novyy – 1 deal at a time!

How Novyy can help you

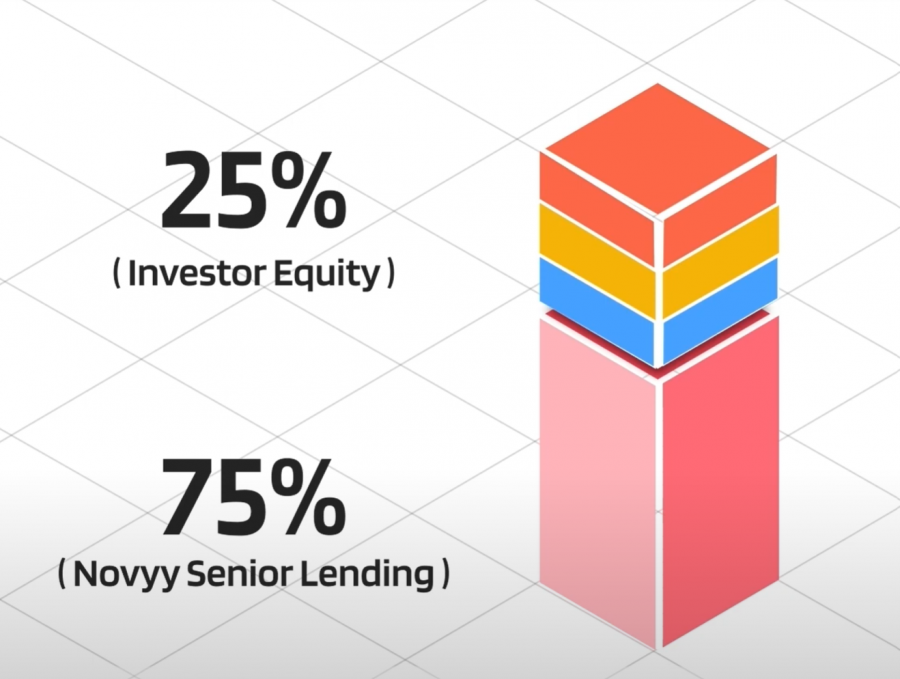

We understand that more and more people are becoming interested in the property market today, but lack the resources to do so. We strive to make the property more accessible to young and/or new investors by offering a fraction of the cost of purchasing a property. (Doesn’t mean experience investors are not welcome). With FI-to-let, our fractional investment method eliminates all of the above hassles for you. As you contribute to a fraction of the equity deposit, we source properties, carry out due diligence, fund the mortgage, and continue to let and manage the property on your behalf. With Novyy you can invest as little as £10,000. Watch our Video.

You can rest assured that our business model will contribute to changing the face of Buy-To-Let forever while allowing you, the investor to sit back and relax while your money does the work for you. In the next five decades, any £10,000 you invest today could be worth 50 times more. Remember - property has been, is, and will remain the best performing long-term asset for conservative investors in the UK and globally. Unlike other high performing investment options like Crypto Currency or Start Ups where your savings could simply disappear, property investing is far safer because there is an asset which you can touch and feel forever.

About Us

We are a new age co-ownership platform focusing on co-living solutions for the country’s future workforce. We are Novyy – built on the Private Equity Buyout Investment Model, for the everyday investor who seeks to enjoy fixed income streams and hassle-free investing.