Are you ok with optional cookies ?

They let us give you a better experience, improve our products, and keep our costs down. We won't turn them on until you accept. Learn more in our cookie policy.

Real estate asset-backed securitization (ABS) is a financial process involving the consolidation of real estate-related debt obligations and the issuance of securities backed by these pooled assets. These assets can include residential mortgages, commercial mortgages, and other real estate-related loans. The securitization process transfers ownership of these real estate assets from the original lenders to a special legal entity known as a Special Purpose Vehicle (SPV). Subsequently, the SPV issues securities to investors, with the cash flows from the underlying real estate assets used to pay interest and principal to the investors. These securities are known as real estate asset-backed securities (ABS), and the group of real estate assets generating their cash flows is referred to as collateral or securitized assets.

The real estate asset-backed securitization process involves two main steps. In the first step, a company or financial institution with a portfolio of real estate loans, known as the originator, selects a pool of these loans to remove from its balance sheet. These real estate loans are combined into what is called the reference portfolio. The issuer, often a special purpose vehicle (SPV) established for this purpose, purchases this pool of real estate loans from the originator. The role of the SPV is to buy the real estate loans and take them off the originator's balance sheet for legal and accounting purposes.

The second step involves the SPV providing capital market investors with tradable, interest-bearing securities known as real estate asset-backed securities (ABS) to finance the purchase of the pooled real estate loans. Establishing a trustee account uses the cash flows generated by the reference portfolio, which includes mortgage payments from borrowers. From this trustee account, investors who purchase the real estate ABS receive fixed- or floating-rate payments.

The originator usually continues to service the real estate loans in the portfolio, collecting payments from the borrowers. After deducting a servicing fee, the collected payments are then passed on directly to the SPV or trustee. This arrangement ensures that the investors in real estate ABS receive their due payments from the underlying real estate loan cash flows.

.jpg?1691658979533)

In some cases, the reference portfolio of real estate loans is divided into tranches with varying degrees of risk. These tranches are sold separately, and their seniority determines the allocation of investment returns and losses. The least risky tranche is first in line to receive income from the underlying real estate loan cash flows, while the riskiest tranche holds the final claim. The different tranches typically include junior, mezzanine, and senior tranches, with expected losses concentrated in the junior tranche.

Real estate asset-backed securitization provides a versatile method to finance various real estate assets with stable cash flows, such as residential and commercial mortgages, real estate development projects, and other real estate-related loans. Real estate asset-backed securities (ABS) are a broader category that includes different types of securitized debt, such as mortgage-backed securities (MBS) and other real estate-related collateralized debt obligations (CDOs). These securities give issuers and investors in the real estate market valuable financial options.

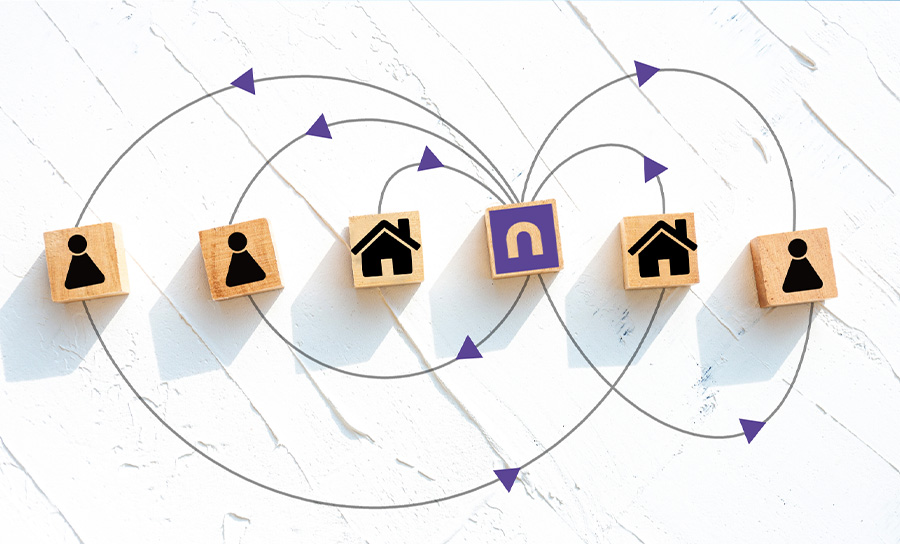

Let's take a look at how Novyy, an aggregating lender, might use asset backed securitization.

Assume Novyy extends financing to 100 individuals looking to buy a property in London.

Now, Novyy groups these 100 mortgages together into a package.

Novyy sets up a special entity named "Novyy-I SPV."

Novyy sells the mortgage package to Novyy-I SPV. This SPV is designed to hold these mortgages.

To fund this purchase, Novyy-I SPV issues called "Novyy-I Securities." These are share certificates.

A Sovereign Wealth Fund or a Pension Fund might buy these Novyy-I Securities to receive regular payments from the mortgages.

Novyy gets a lump sum from selling to Novyy-I SPV. With this money, Novyy can lend to 100 more people, enabling them to buy properties in the UK.

Everyone wins! Investors get regular income, Novyy gets more funds to lend, and individual borrowers keep repaying their mortgages as usual. It's a smart way to make the property market work for everyone involved.