Local buyers, particularly first-time homebuyers, may be sceptical of the UK real estate market presently given the current mortgage crisis, but overseas investors, particularly those from Asia, are undeterred because the primary motive is to invest for wealth building. Despite market hiccups, Asian investors continue to be enticed to UK real estate. However, the market for foreign-country mortgage products has started to evolve . In this piece, we aim out to clarify the subtleties and challenges that foreign national loans may provide for international investors.

But first, consider the various lending options on property permitted by British banks and financial institutions.

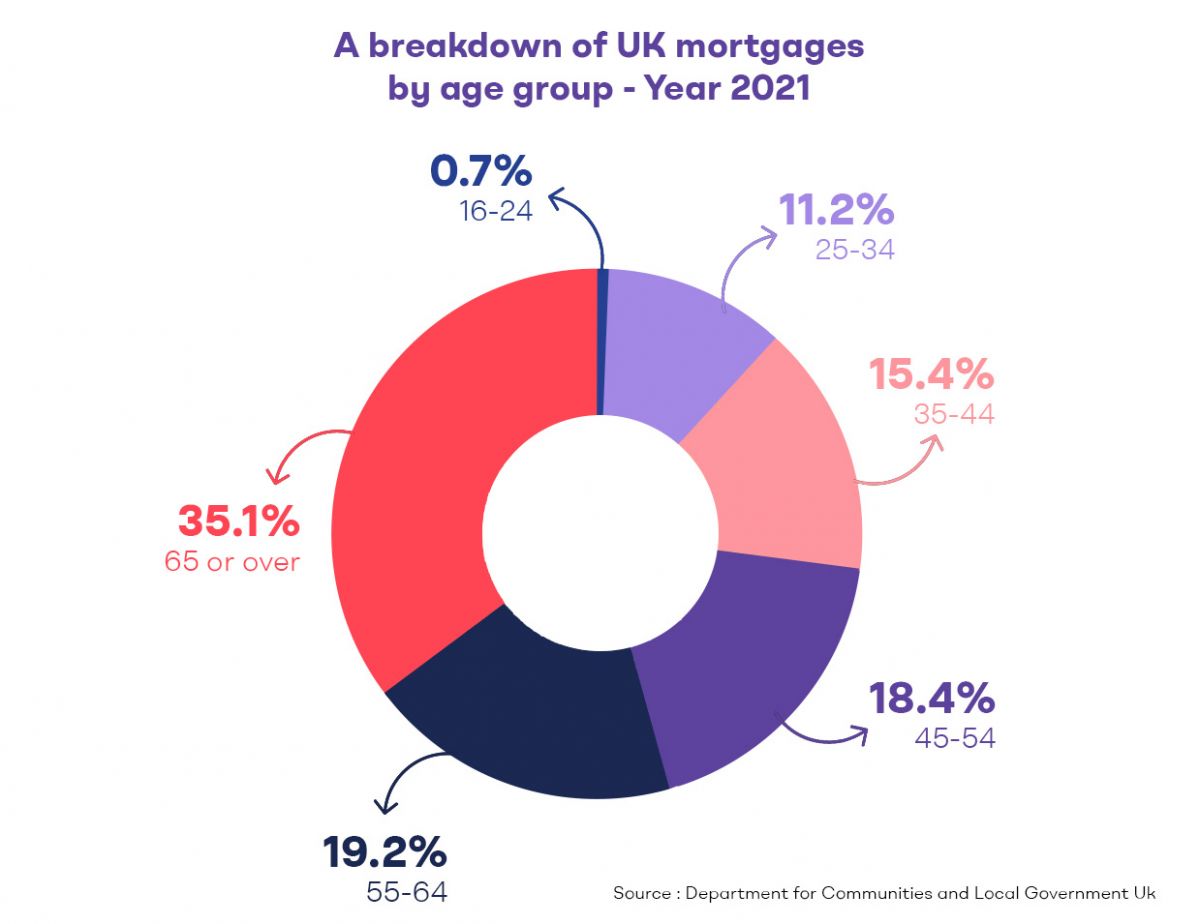

Analysing UK mortgages by age group offers insights into the preferences of different generations in property financing. For international investors, this aids in targeting segments that align with their goals, catering to first-time buyers, families, or retirees.

.jpg?1693570745413)

Understanding how age groups access the property ladder informs Asian investors on diverse entry paths, aligning strategies with buyer preferences.

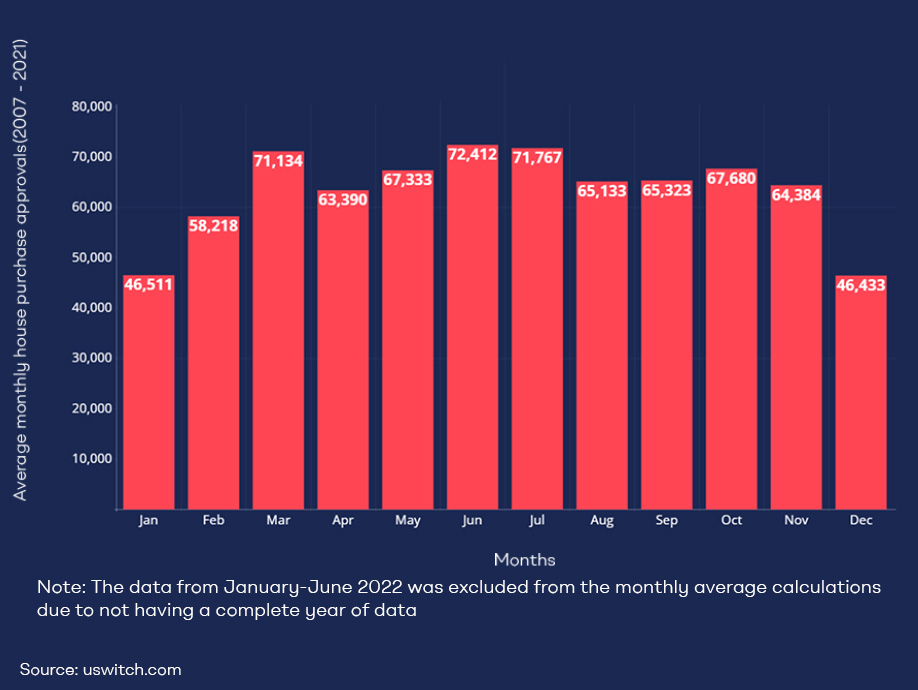

Tracking historical mortgage approvals informs foreign investors about market trends, empowering timely investment decisions.

International investors, especially those from India, HongKong and China, remain steadfast in the face of uncertainties in the UK real estate market. While local purchasers approach the market cautiously, foreigners show steadfast interest in purchasing property in the UK. The robustness of the UK real estate market among international investors is shown in this persistent demand.

An increase in inquiries about mortgages from other nations indicates increased interest among international investors. The eligibility of non-EU, non-EEA, and non-UK foreign nationals, the possibilities for VISA holders, and the viability of consideration for people with less than three years of UK residency are frequently asked questions.

The mortgage market for foreign nationals is changing, revealing opportunities as well as difficulties. Opportunistic overseas investors bought inexpensive UK real estate in the autumn of 2022 as a result of the sharp decline in the value of the pound. However, the rise in cash purchases raises concerns about potential difficulties in obtaining mortgages from foreign nationals, which may be related to stricter lending standards.

It is crucial to comprehend how foreign mortgage applications are judged. Although they resemble conventional mortgages, these specialised mortgage products for international borrowers also include detailed analyses. Based on the borrower's place of residence, different lending standards that take into account perceived risks may be applied.

Foreign revenue adds complexity because of changing currency rates. For mortgage applications, the majority of UK lenders require the conversion of foreign income into pounds, adding another layer of complexity for potential buyers. There are still only a few mortgage lenders willing to lend to foreigners, including reputable companies like Novyy, HSBC, Barclays, NatWest, and Skipton International.

Different lenders place different weights on visas when approving mortgages. Some only serve people who have permanent residence, while others are more welcoming to people with visas. Many UK visa categories, such as Tier 1, 2, and 5 visas, spousal and ancestry visas, student visas, and work visas, have a significant impact on mortgage eligibility.

Sophisticated financial solutions have emerged as a result of the complex world of mortgages for foreign nationals. Offerings like Foreign Nationals/Overseas Bridging Finance offer specialised assistance, ensuring that real estate investments succeed regardless of complexity or credit background.

It's essential to have a thorough understanding of both UK and foreign tax repercussions before investing in UK real estate. Domicile and residence status determine UK tax liabilities and affect both UK residents and non-residents' access to tax benefits. Structures like non-UK-resident businesses or trusts might be investigated as potential options for maximising tax efficiency and protecting assets.

Foreign investors can take advantage of the potential of the UK real estate market despite its complexities and difficulties by taking out loans from other countries. The key to successful investing endeavours is navigating the complexity of mortgages while effectively addressing tax considerations. With a thorough understanding of financial and tax implications, foreign investors are well-positioned to begin a successful journey into the booming UK real estate business.